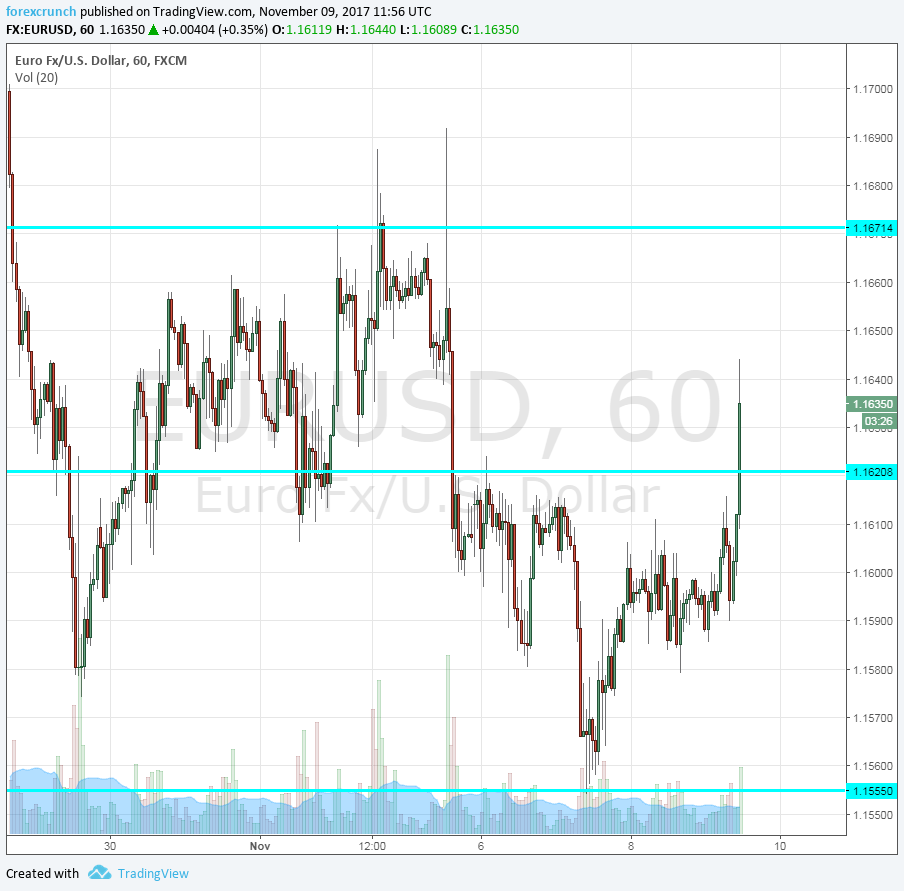

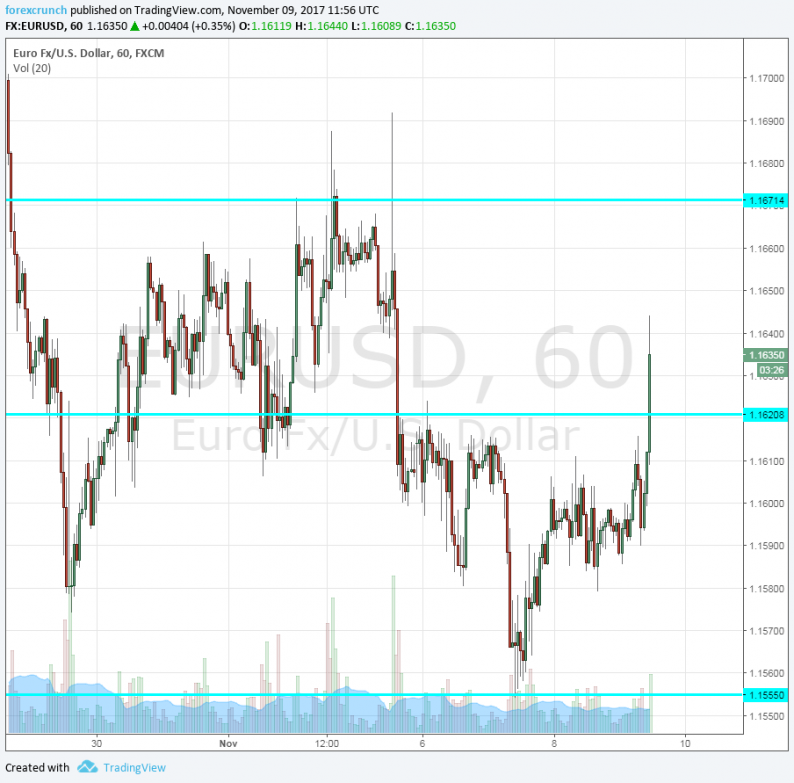

EUR/USD is trading at 1.1637, up some 50 pips from the lows of the day at 1.1585 and some 80 pips from the lows of 1.1555 seen earlier in the week.

There is no sole driver that pushes the pair to the upside, but data has been positive. The European Commission upgraded economic forecasts for the euro-zone, from 2.1% to 2.2%. ECB member Benoit Coeure said that the 19-currency bloc is seeing robust growth.

In addition, Germany’s trade balance came out at a wider surplus than expected: 21.8 billion, even though both imports and exports slipped.

This trading week does not feature huge economic indicators as we’ve seen beforehand, and this is when the euro rises. The aforementioned trade balance surplus of Germany and the euro-zone as a whole means that more money flows into the area than leaves it. Of course, with economic indicators, monetary policy, statements and political events, speculation has the upper. However, when (almost) nothing happens, the euro is naturally bid.

Further resistance awaits at the 2016 peak of 1.1620. This is followed by the 1.1670 level, and then 1.1710. Support now awaits at 1.1555.

Here are the recent moves on the EUR/USD hourly chart:

Leave A Comment