Have stocks become less risky? It certainly feels that way…

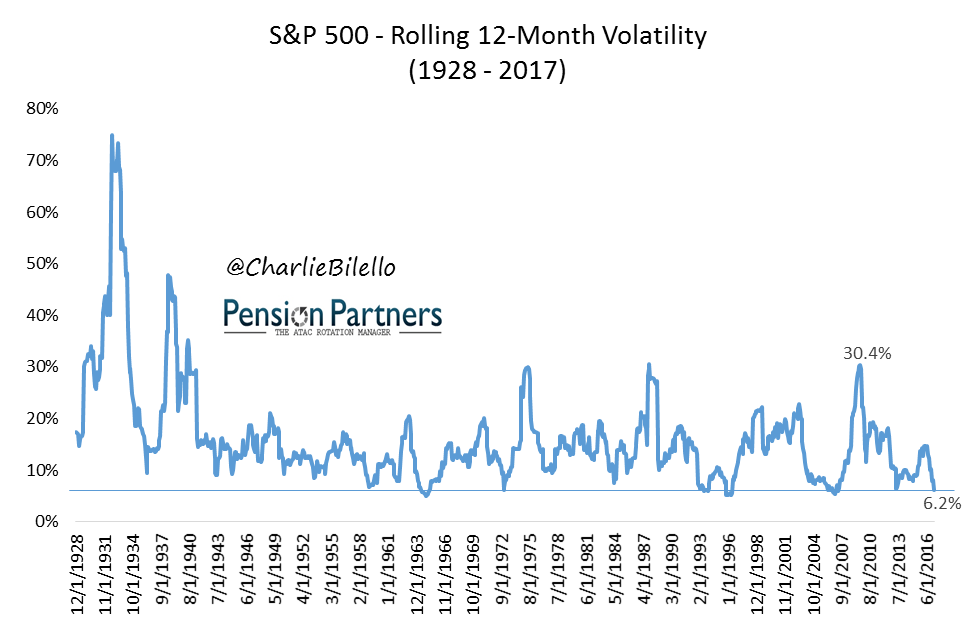

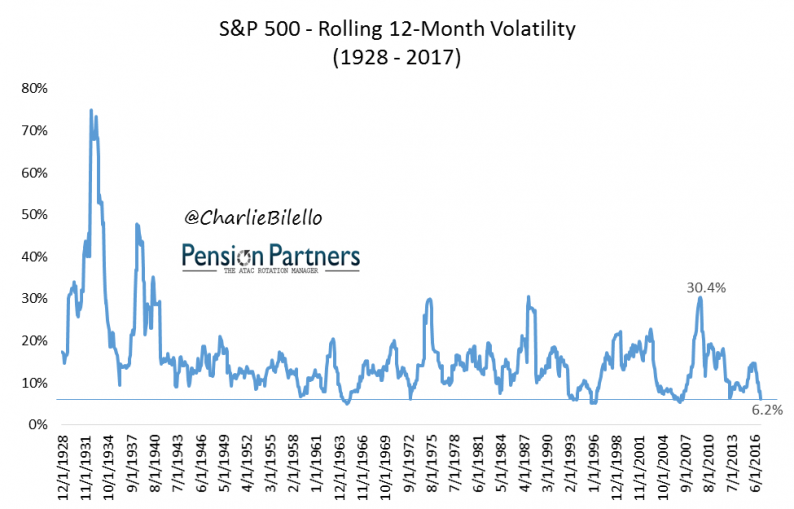

1) Annualized volatility in the S&P 500 has moved down to 6.2%, its lowest level since May 2007. Going back to 1928, the volatility over the past year has been lower than 97% of historical periods.

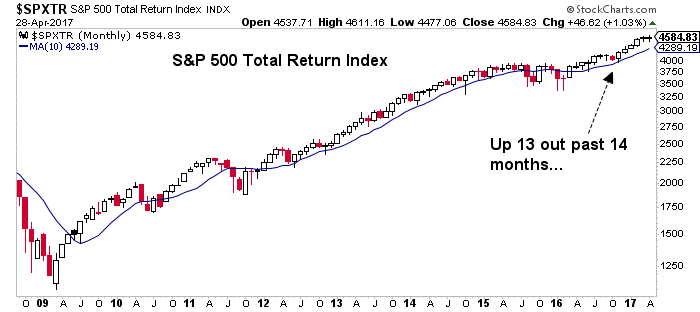

2) Not only has volatility been low, but the market has been higher on a much more consistent basis. Since 1928, the S&P 500 has been up on a monthly time frame 62% of the time. By contrast, over the past 14 months, the S&P 500 has been up 13 times, a win rate of 93%.

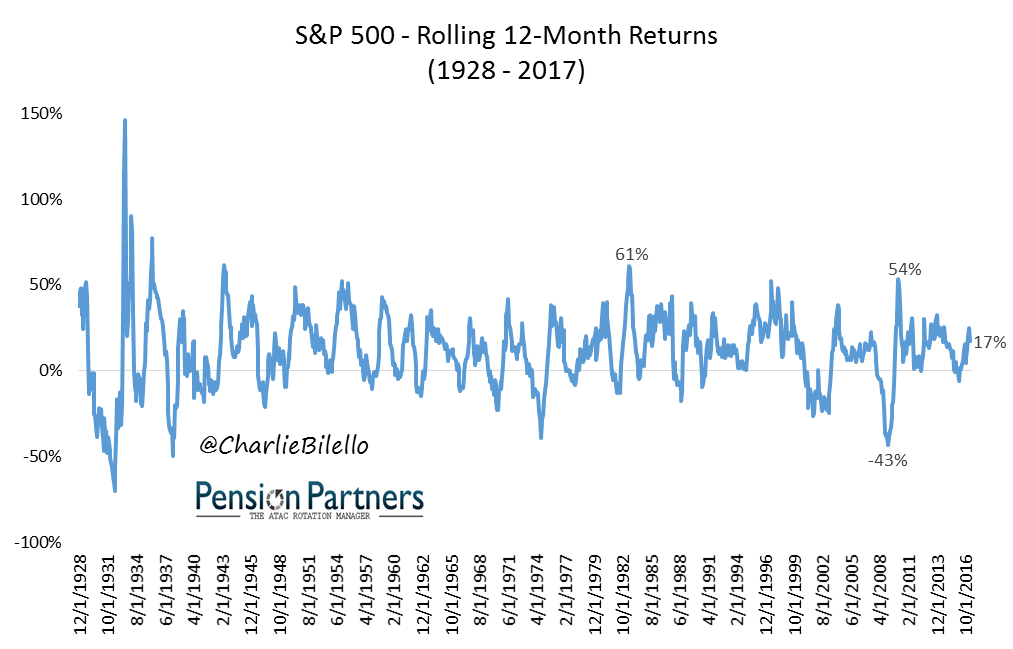

3) On a rolling 12-month time frame, the S&P 500 has been positive 74% of the time historically. Since October 2010, this win rate has moved up to 96%.

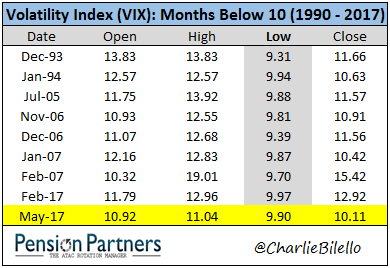

4) The Volatility Index moved below 10 this week to its lowest level since February 2007. This was only the 9th month since 1990 that the VIX has dipped below 10.

Any way you look at it, volatility is very low. At the same time, investors have experienced gains with a much higher level of consistency than in the past. As investors tend to equate volatility with risk and consistency with a lack thereof, many will conclude that risk today is extremely low.

But is this actually the case? Have stocks become less risky?

Count me as skeptical. Nassim Taleb once said: “don’t confuse a lack of volatility with stability, ever.” Low volatility can create an illusion of current stability, but unless it is actually predictive of future stability, it is merely an illusion. If low volatility were predictive of low risk, you would not have seen near record-low levels of volatility in early 2007 when risk was actually at its highest level in decades.

If not volatility, what should investors fear? My view is similar to that of Howard Markets. Investors should fear a permanent loss in capital. A permanent loss can come from the investor (selling out on a decline due to necessity or emotion) or from the investment (Enron, Worldcom, Lehman, Subprime Mortgage Bonds, etc.).

Leave A Comment