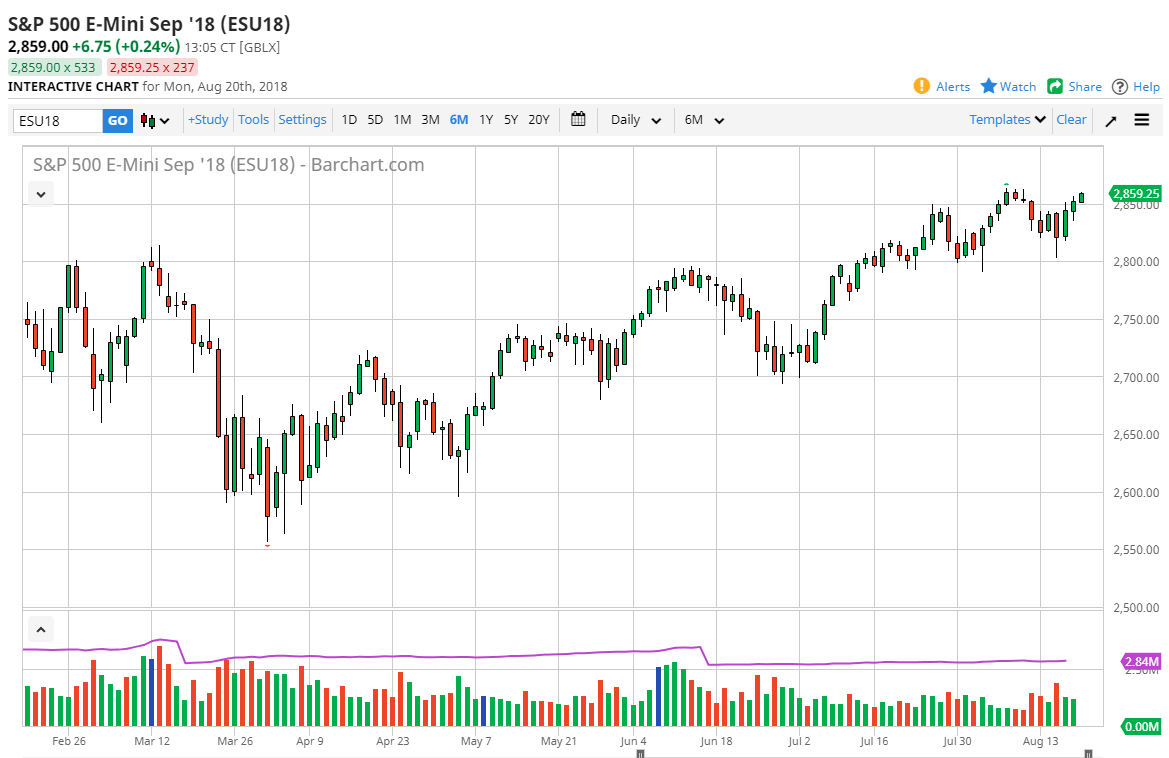

S&P 500

The S&P 500 rallied slightly during the trading session on Monday as traders came back to work. We are still just underneath the highs that were made a couple of weeks ago, but it does look like we are going to try to break through. Short-term pullbacks could continue to be buying opportunities, as there has been more than enough buying underneath. I believe that the 2800 level underneath is essentially the “floor” in the market, and it should keep this market afloat. If we can break out to a fresh, new high, then the market should go to the 2900 level, followed by the 3000 level. Needless to say, there is concern about global growth, and that of course will have an effect on the S&P 500 as well. I don’t have any interest in shorting this market right now, although I think there will be pullbacks.

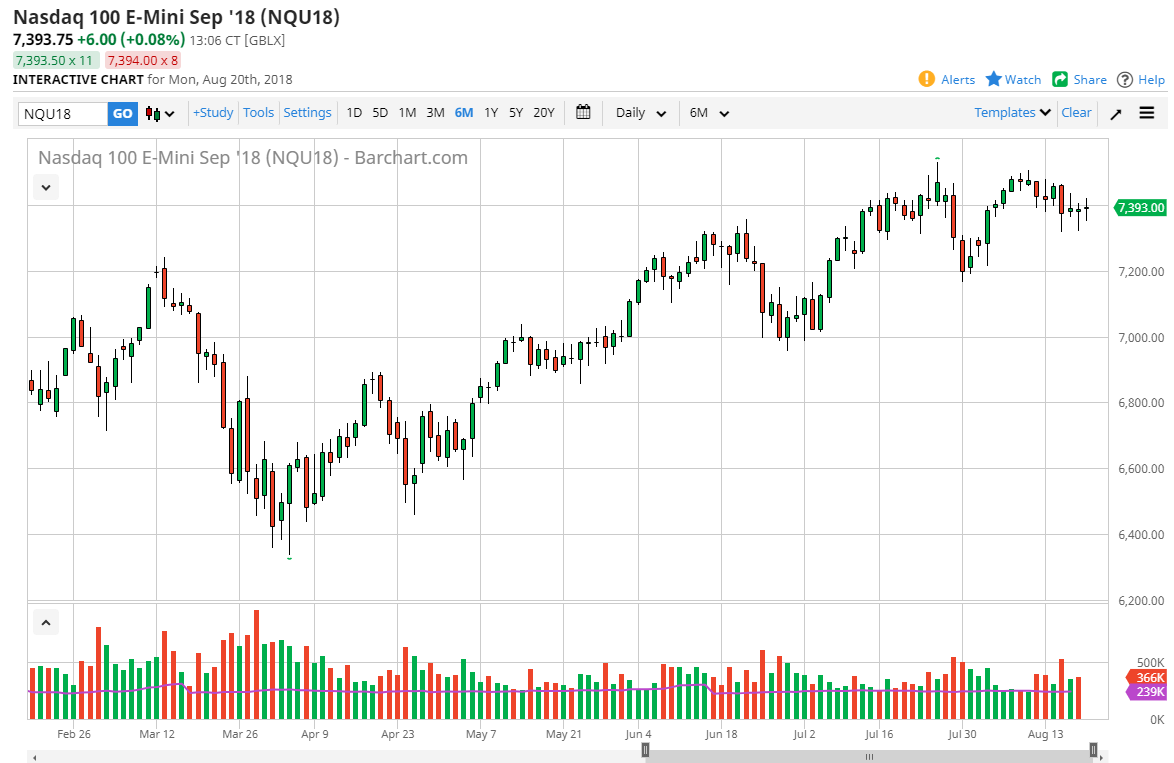

Nasdaq 100

The Nasdaq 100 was relatively flat during the trading session as technology stocks continue to get it. I think at this point, the market will probably continue to find buyers on dips, but I believe that the Nasdaq 100 is going to underperform the S&P 500 as large stock-holders are starting to rotate out of technology and into consumer staples and the like, which of course favors the S&P 500 overall. The “floor” in this market is the 7200 level from what I see right now, with the “ceiling” being closer to the 7500 level. I think that looking for value is probably the best way to play the Nasdaq 100 right now, but I would not expect to perform as well as the S&P 500, the Dow Jones Industrial Average, or even the Russell 2000.

Leave A Comment