Investors in 2015 may be forgiven if they feel like bobbleheads. The volatility of the markets, the speed with which opinion-holders dispense information about any event (some of it even accurate) and the sheer volume of too much data can make our head, and our thoughts, swing too rapidly hither and yon, leading us to trade wildly, making brokers richer and investors poorer.

Of course, there are investors who claim they do not care one whit where the markets are or at what price their securities are selling. They take pride in spending no time studying the ways of the market but, rather, seek only to match the long-term performance of the market they choose to invest in and let the chips fall where they may when there are corrections.Many such investors are adherents of John Bogle’s approach to investing and delight in calling themselves Bogleheads. Whenever I disagree with the premise of that thinking, “the phones are sure to light up” and the comments section will be filled with righteous indignation or derision from these acolytes.

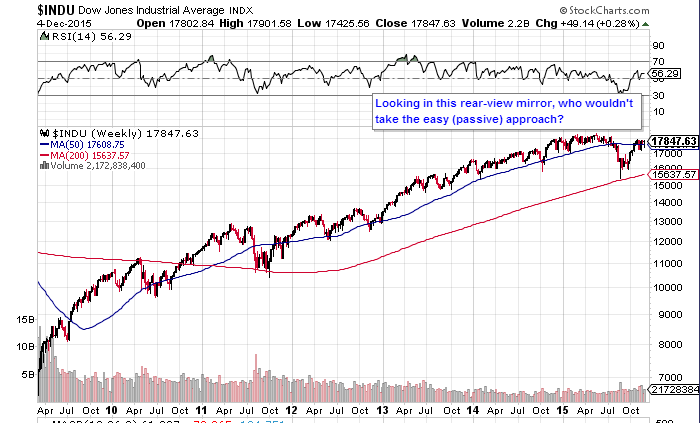

The idea of buy-and-hold passive investing and holding a broad brush of securities is hardly new — but its popularity waxes and wanes with the market itself. For instance, whenever the US stock market is doing well as (until this year) it has since March of 2009, people who invest with a rock-steady eye on the rear-view mirror will pound the drum for passive investing via the cheapest ETF.

But how many of these investors, or their predecessors, really did hold on to their portfolio from Oct 2007 to March 2009 — and if so, what in tarnation were they thinking? As you might recall seeing the chart below, that was a particularly terrifying slide of a minus 53.5%in less than a year and a half.Buying passive index ETFs and holding is popular yet again, looking at the rear-view mirror back only as far as 2009, but those looking backward in March of 2009 abandoned this strategy in droves:

There has to be a better way of investing than either day-trading between biting one’s fingernails to the nub, or stubbornly clinging to the notion that its OK to hold on during a 53.5% rollercoaster decline because after all, “the market always comes back.”(It’s true that the market came back after 2009 but it took 5 years, 4 months and 15 days to break even, not allowing for inflation.Not very helpful if you plan to retire in 5 years!)

Leave A Comment