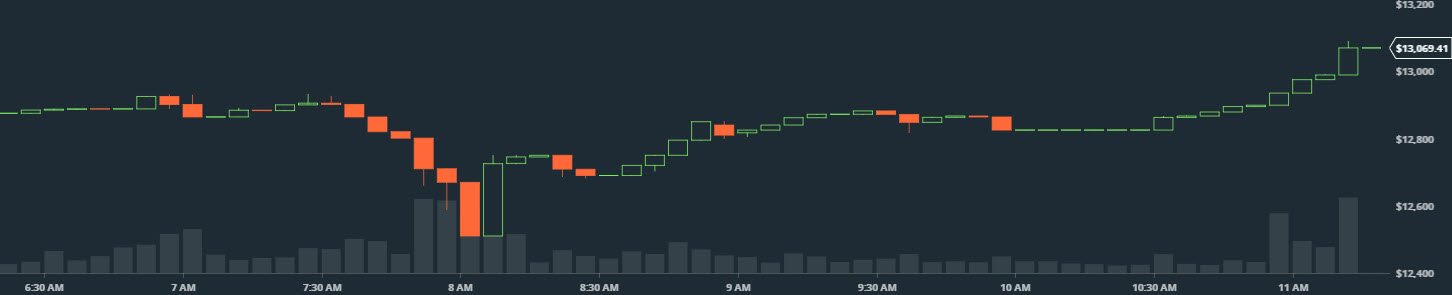

For the first time in history, the price of Bitcoin has surpassed $13,000 (rising from $12,000 in less than a day).

For those keeping track, this is how long it has taken the cryptocurrency to cross the key psychological levels:

image courtesy of CoinTelegraph

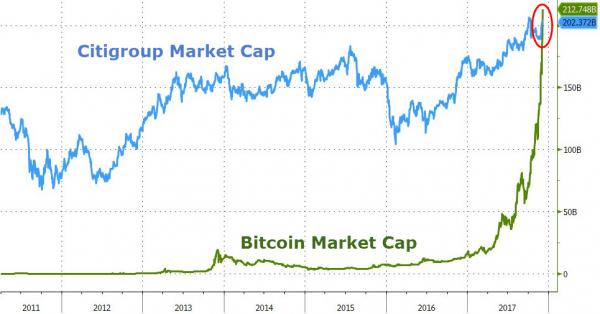

This pushes Bitcoin’s market cap to around $220 billion (above that of Citigroup) as the market cap of the entire cryptocurrency space is now bigger than JPMorgan.

While no specific catalyst is clear, we note two headlines that stood out:

Tokyo Financial Exchange to Begin Planning for BTC Futures

The Tokyo Financial Exchange, one of Japan’s leading financial exchanges, has announced that they will begin preparations for Bitcoin futures offerings at the beginning of 2018. The company boasts some high value trading partners like JP Morgan Chase and Barclays.

The announcement suggests that the exchange will build a working group to study cryptocurrencies and the potential for futures this January. The working group is the first step toward final action and is generally a strong signal for adoption, since it preceded legislation for approval. According to the CEO Shozo Ohta:

“Once the Financial Instruments and Exchange Act recognizes cryptocurrencies as financial products, we will list the futures as quickly as possible. To achieve that, we will launch this working group to study various aspects, including Bitcoin’s present status, its outlook, and what form it will take root in Japan’s society.”

The announcement falls in line with Japan’s previous moves toward adoption of Bitcoin and other cryptocurrencies. The country was one of the first to recognize Bitcoin as a legal payment method, and has been open to increasing changes. At present, Japan is the world’s largest Bitcoin market, with about half of all Bitcoin trades globally being denominated in yen.

Leave A Comment