The Treasury market isn’t the only place where the idea of “globally synchronized growth” is proving a tough sell. The collapse of the yield curve suggests, in fact, it isn’t being bought one bit. Apart from bonds, US companies aren’t warming to the economic warming, either.

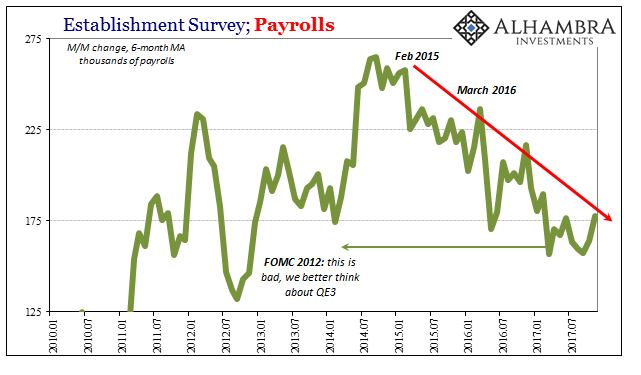

The labor market apart from the unemployment rate remains suspiciously subdued. According to the BLS’s Establishment Survey, the rate of hiring peaked in early 2015 coincident to the initial bout of the “rising dollar.” That monetary event then produced a significant (and global) economic downturn including a profit recession for Corporate America as well as small businesses everywhere.

It was right around that time labor market growth slowed that much more, including the shockingly weak payroll report for May 2016 (just +43k, not statistically different from zero or even negative). Companies squeezed by the effect of the downturn on revenue growth reacted as you would expect. They didn’t cut jobs as they might have in a serious recession, but they stopped hiring at the rate they once were (and then, apparently, forgot to send a memo to Janet Yellen apprising her of their clear economic shift).

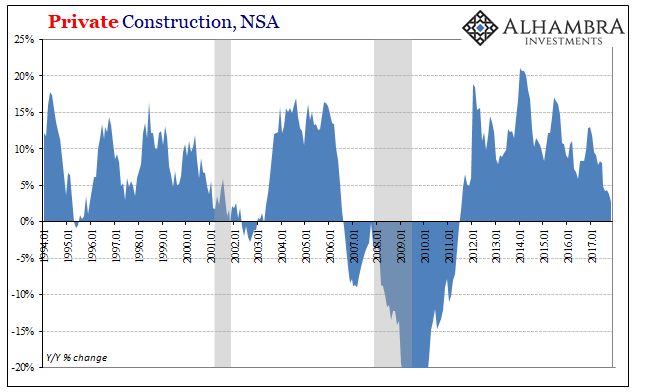

That wasn’t the only cutback in growth among business input costs, however. The Census Bureau’s estimates for construction spending now through November 2017 show that Non-residential Construction output is in contraction.

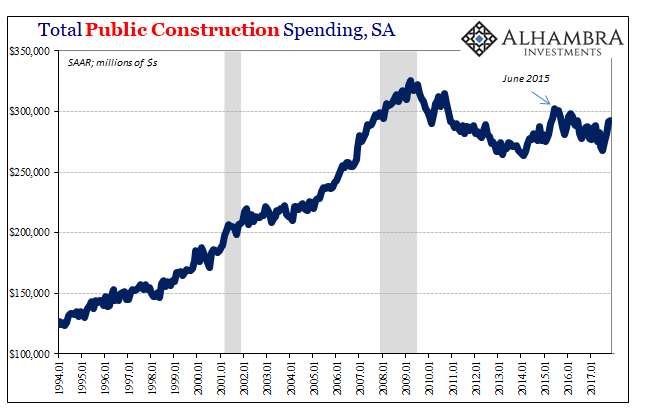

Overall, construction spending is growing very slowly, almost flat (+2.6% year-over-year). It would have been about zero in the latest month had Public Construction Spending not reversed sharply the past two months. That might have been delayed activity from several years now of steadily lower outlays, or it might have been related to storm cleanup and rebuilding in Texas and Florida.

Either way, local governments continue to operate without a clear path to tax growth (more on that later). Despite “reflation” in the economy last year, there hasn’t really been all that much of it outside of sentiment.

Leave A Comment