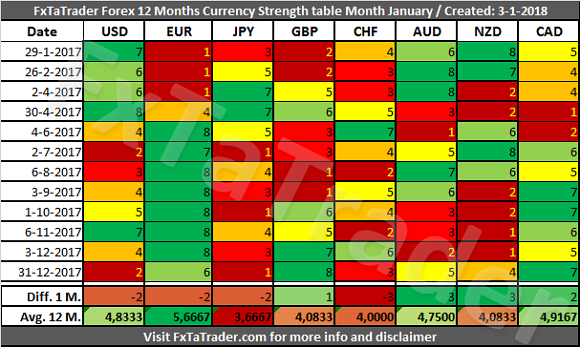

In the Currency Strength table, the GBP was the strongest currency while the JPY was the weakest. There were some significant changes last month with the AUD and NZD gaining 3 points while the CHF lost 3 points. On a

January 3, 2018

Construction spending rose more than expected in November. Revisions add to the gains. Here are some highlights from the Census Bureau’s Monthly Construction Spending Report for November 2017. Total Construction Construction spending during November 2017 was estimated at a seasonally adjusted annual