Copper, European banks, and emerging markets all entered into bear market territory last week and the trillion dollar question strategists are asking is whether US markets are likely to get pulled down as well, especially with fears that a full-blown trade war may crash the global economy.

With this now being the longest bull market in US history as of Wednesday, August 22, we take a look at financial conditions, the yield curve, jobless claims, and our Fed funds risk neutral index to see whether the bullish primary trend in the US stock market and economy is in danger of coming to an end.

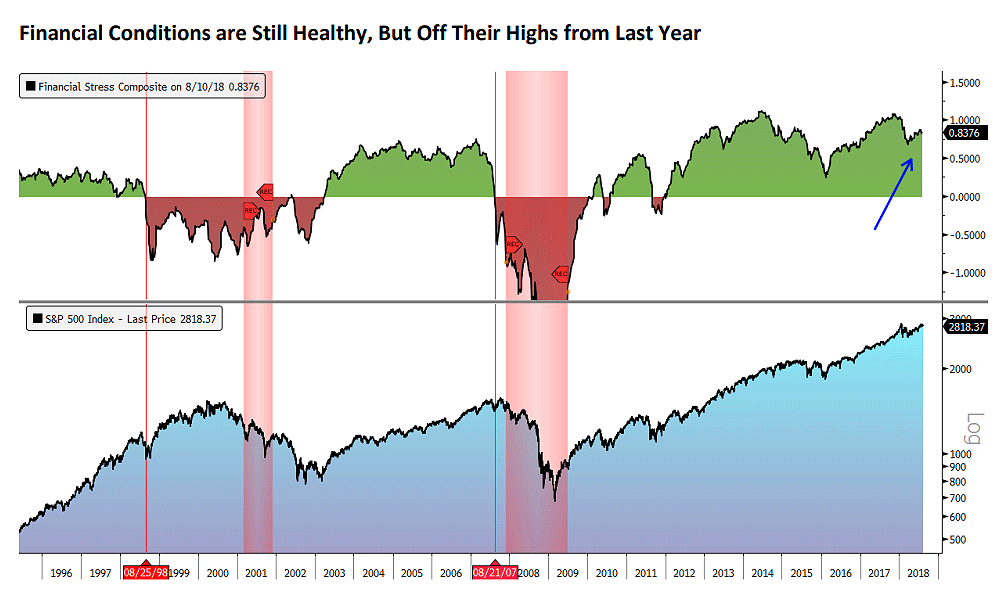

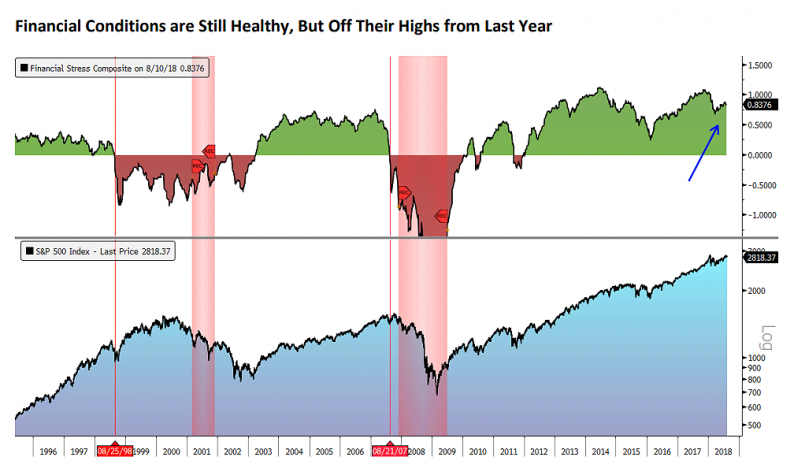

Financial Conditions Still Healthy

In our Big Picture segment from earlier this month, No Recession or Bear Market, But Plenty of Turbulence, Jim Puplava warned that problems overseas would likely cause some market volatility but argued that an imminent recession or bear market in the US was unlikely.

When it comes to gauging the risk of a stock market top and the possibility of an imminent recession, one way to do this is by looking at the level of stress in the financial system via interbank lending rates, yield spreads, return correlations, stock market volatility, and other measures.

As we discussed on FS Insider last week, financial stress levels in the US are still quite low and are not raising a red flag, something that usually precedes major turning points in the market.

Source: Bloomberg, Financial Sense® Wealth Management. Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly

As you can see in the chart above, financial stress levels moved into the red zone as problems in Asia and Russia spread to Long-Term Capital Management in the late ’90s and then again at the peak of the market in 2007. Currently, however, financial stress conditions are quite healthy and, without a sudden decline, are supportive of the market outlook.

Leave A Comment