The happy days on Wall Street have never been happier.

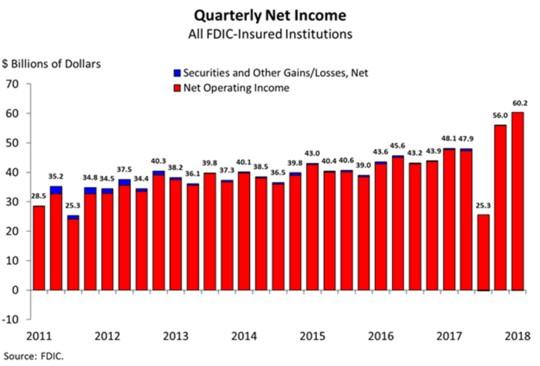

According to the latest quarterly FDIC report released on Thursday, banks reported aggregate net income of $60.2 billion in the second quarter of 2018, up $12.1 billion (25.1%) from a year ago and a new quarterly record. Only 3.8% of institutions were unprofitable during the quarter, down from 4.3%in second quarter 2017. The average return on assets was 1.37%, up from 1.13% a year earlier, most of it again thanks to Trump’s tax law.

The improvement in earnings was mostly attributable to higher net interest income and a lower effective tax rate, which contributed more than $6 billion to the bottom line. Assuming the effective tax rate before the new tax law, net income would have totaled an estimated $53.8 billion, an increase of $5.6 billion (11.7%) from Q2 2017.

The FDIC reported that bank net interest income totaled $134.1 billion, an increase of $10.7 billion (8.7 percent) from 12 months earlier and the largest annual dollar increase ever reported by the industry. Specifically, more than four out of five banks (85.1%) reported year-over-year increases.

Meanwhile, net interest margin (NIM) rose fractionally to 3.38%, up 16 bps from a year earlier, as average asset yields grew more rapidly than average funding costs, although it wasn’t clear if these numbers are actuals or pro forma.

One potential caution: institutions with assets of $10 billion to $250 billion reported the largest annual increase in average funding costs (up 30 basis points), as a result of the Fed’s rising interest rates. Still, the improvement in NIM was widespread, as more than two out of three banks (70.2 percent) reported increases from a year earlier.

Noninterest income also increased but at a more modest pace, rising to $68.1 billion, an increase of $1.3 billion (2%) from the previous year. The 12-month increase in noninterest income was attributable to servicing fees (up $638.2 million, or 29.5 percent), fiduciary activity (up $558.4 million, or 6.3 percent), and net gains on sales of other assets (up $388.3 million). Slightly more than half of all institutions (55.6 percent) reported increases in noninterest income from a year earlier. Which also means that slightly less than half of all banks reported a decline.

Leave A Comment