The Fed G17 report shows Industrial Production is up 0.4% this month, but the manufacturing component weighted at about three-fourths of the total has been barely growing for some time.

The Fed revised May from flat to +0.1 and April from +1.1 to +0.8.

The Econoday consensus was for 0.3% growth.

Mining is once again the highlight of an otherwise soft industrial production report. Gaining 1.6 percent for a third straight sharp increase, mining pulled industrial production up 0.4 percent in June as utilities posted no change and manufacturing managed an as-expected 0.2 percent gain.

Manufacturing makes up the vast bulk of the industrial sector and a breakdown does show strength with vehicles up 0.7 percent and selected hi-tech up 0.8 percent. But both consumer goods and business equipment came in flat with construction supplies down slightly.

The gain for manufacturing follows May’s 0.4 percent decline with a 1.0 percent surge in April nearly offset by March’s 0.8 percent plunge. The factory sector is moving forward, just not very fast. Today’s report is the first definitive factory data for June; watch next week for the first tentative data on May [I believe Econoday means July] with Empire State on Monday and Philly Fed on Thursday. Note that traditional non-NAICS numbers for industrial production may differ marginally from NAICS basis figures.

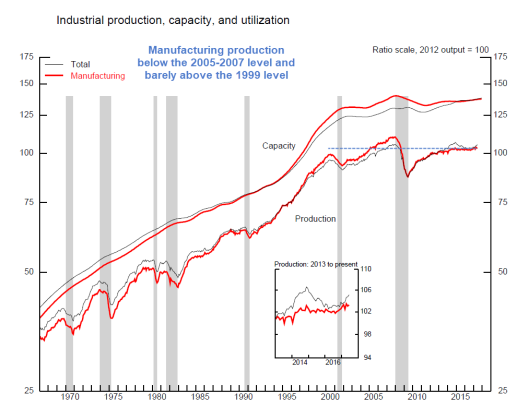

Industrial Production and Capacity Utilization

Manufacturing production is below the 2005-2007 level and barely above the 1999 level.

2016 Weightings

Curiously, motor vehicles and parts account for only 5.77% of the total but account for nearly 20% of retail sales.

Reader Comment

Reader ucanbpolitical writes: “Mish, no doubt you will be commenting shortly on the extraordinary figures for industrial production. A quick, back of the envelope calculation, makes it hard to square retail sales with imports/exports, inventory and industrial production. Since December 2016 industrial production rose 1.3% but factoring in real net exports, real retail sale growth which is nonexistent and Nowcast’s estimation of inventory growth, the figures do not reconcile. There is no scope for the growth in industrial production announced over the last 6 months. Perhaps you can reconcile these figures.”

Leave A Comment