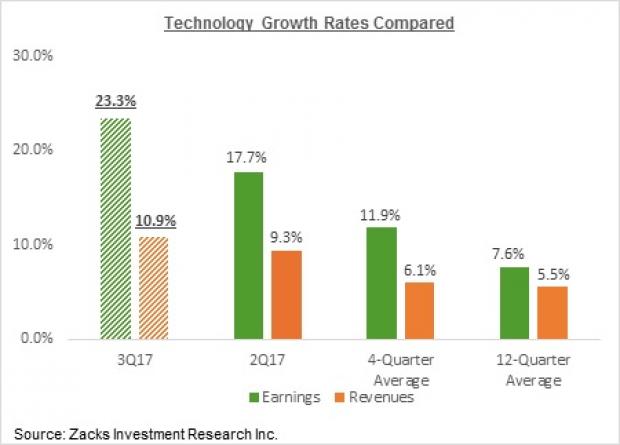

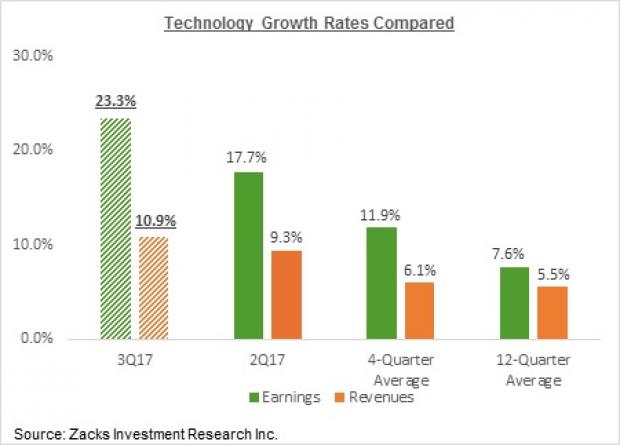

As of yesterday, earnings for the Zacks Computer and Technology sector were up +23.3% from a year ago, with revenues up +10.9%.This amazing performance is not expected to be an isolated to Q3 17, as current estimates are pointing to double digit growth over the next three quarters as well.Within the tech sector, the three biggest areas of growth are expected to come from the cloud, IoT (internet of things), and data centers.The table below shows the earnings and revenue growth for the most recent time periods, and some historical context.

It is also important to point out that these growth numbers are not accounting for any new tax changes.These tax cuts and potential repatriation could be a significant tailwind for these companies in the coming quarters as well.The repatriation could be used for share buybacks, and increased dividend payments.While the tax cuts will also help the bottom line.

With the technology sector expected to see sizable growth over the next several quarters, we wanted to identify the best tech heavy mutual funds to take advantage of this extended uptick.First, we started with the Zacks Mutual Fund Screener, and looked for funds that had at least 75% exposure to technology growth stocks, a low expense ratio, no load fees, 1 year total return of +20% or better, 3 year total return of 15% or better, and a Zacks Rank #1 (Strong Buy), or a Rank #2 (Buy).From the results, we picked the top 3 (out of 6 that met these criteria).

The Picks

Columbia Global Technology Growth (CMTFX – Free Report), a Zacks Rank #1 (Strong Buy) seeks capital appreciation by investing at least 65% of its assets in equity securities of technology companies that may benefit from technological improvements, advancements or developments and which have attractive growth prospects.

Current Sector Allocation:As of the last filing, the company has 79.62% of the portfolio in the technology sector, with small weightings in Other (6.5%), and Finance (3.7%).

Leave A Comment