While fast-growing momentum stocks might get the headlines, some of the best long-term investments are often far less exciting dividend growth stalwarts such as 3M (MMM).

This industrial powerhouse has made countless investors amazingly wealthy over the years (12.9% total returns vs 9.1% for the S&P 500 over the last 22 years) thanks to its disciplined and steady growth strategy, which includes 59 straight years of dividend increases at a double-digit annualized rate.

Let’s take a look at what has made this venerable dividend king one of the best choices for almost any long-term income growth portfolio and if 3M’s valuation looks attractive today.

Business Overview

Minnesota Mining and Manufacturing, or 3M, was founded in 1902 in St. Paul, Minnesota. The global industrial conglomerate markets over 60,000 products used in homes, businesses, schools, and hospitals in over 200 countries around the world. The company has five main business segments.

Industrial: tape, sealants, abrasives, ceramics, and adhesives for automotive, electronic, energy, food, and construction companies.

Healthcare: Infection preventions supplies, drug delivery systems, food safety products, healthcare data systems, dental and orthotic products.

Electronics & Energy: insulation, splicing and interconnection devices, touch screens, renewable energy components, infrastructure protection equipment.

Safety & Graphics: Personal protection and fall protection equipment, traffic safety products, commercial graphics equipment, commercial cleaning and safety products.

Consumer Products: post-it notes, tape, sponges, construction & home improvement products, indexing systems, and adhesives.

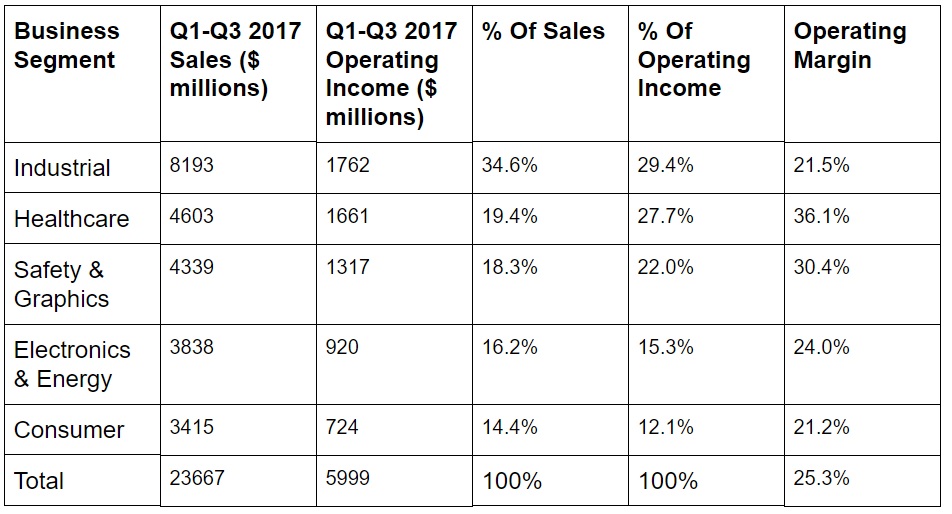

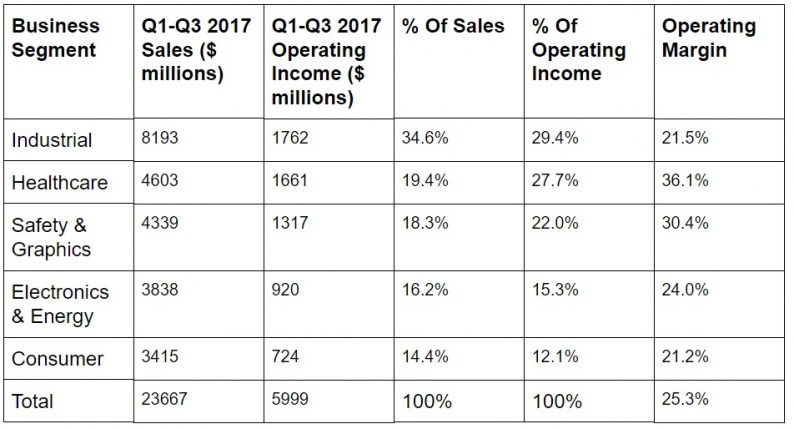

3M is a highly diversified company with industrial products representing its largest business unit, while healthcare is its most profitable segment by far.

Source: 3M Earnings release

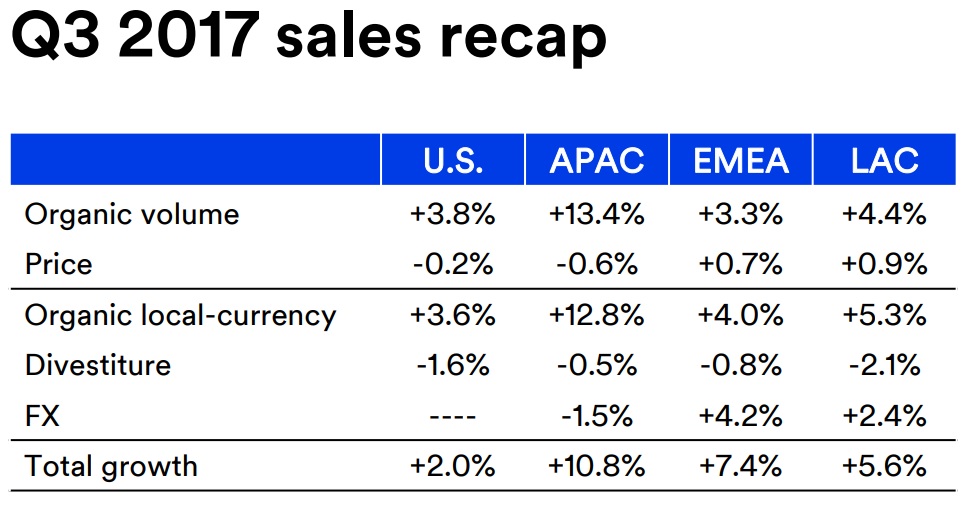

Geographically 3M is also diversified, with a large amount of international sales:

Over time, 3M’s international exposure will only grow given that its foreign sales are growing much faster than its US revenues.

Source: 3M Earnings Presentation

Business Analysis

The industrial components industry has a lot of factors that might make it seem unattractive for dividend investors. After all, it’s a cyclical and highly capital intensive industry, with relatively low barriers to entry.

In addition, most industrial products are highly commoditized, meaning that it’s hard to maintain strong pricing power and good margins over time.

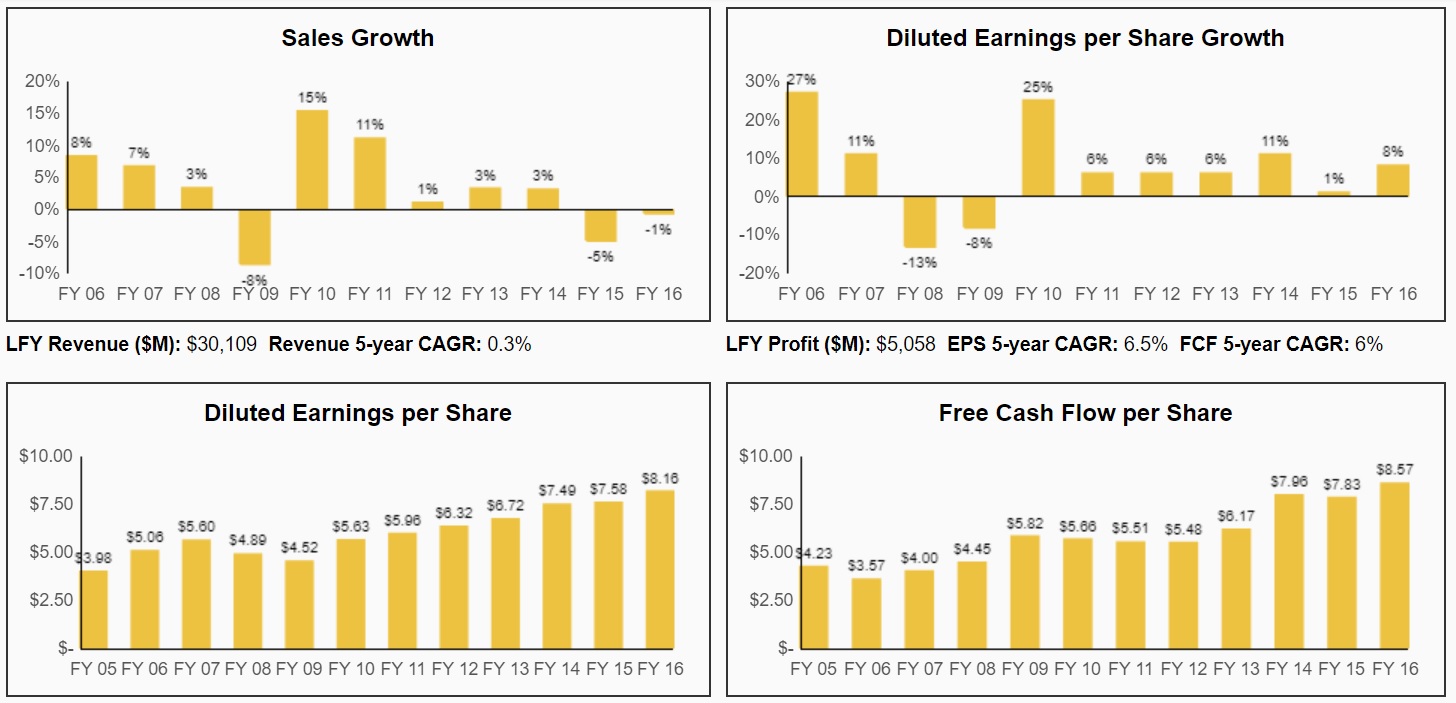

However, 3M has managed to carve out a very wide moat and has shown an incredible ability to continue growing its earnings and cash flow over time, despite the occasional industry downturn such as 2015 and 2016 (due largely to tumbling commodity prices).

Source: Simply Safe Dividends

The key to 3M’s success is largely thanks to its conservative management and disciplined long-term focus. CEO Inge Thulin has been with the company for 38 years and understands that the key to 3M’s growth lies in its continued dedication to strong R&D and new product development.

Over the past 115 years, 3M has obtained over 100,000 patents thanks to one of the industry’s highest R&D budgets (as a percentage of revenue). The company is constantly improving its existing product range and introducing new ones. In fact, about 33% of 3M’s sales are from products launched in just the past five years.

Source: 3M Investor Presentation

Another benefit 3M has is that about 50% of its products are consumables, meaning that customers need to continually repurchase them. This creates a far more stable cash flow stream for the company. Finally, 3M benefits from selling many specialized, mission critical, but still relatively low cost products to industrial customers.

This means that the components it makes represent a small fraction of the total cost of goods, and because of their industry-leading reliability and performance characteristics, industrial customers are less likely to switch to competing products.

Or to put it another way, 3M has a very sticky product line that allows it to steadily increase its prices each year while retaining strong customer loyalty and a rising market share. This is why its industrial segment has historically grown at 1.5x the rate of the global manufacturing components industry.

Leave A Comment