Tuesday, February 9

Wednesday, February 10

Thursday, February 11

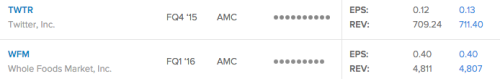

Disney (DIS)

Consumer Discretionary – Media | Reports February 9, after the close.

The Estimize consensus is calling for EPS of $1.46, two pennies ahead of Wall Street, and indicating YoY growth of 15%. Revenues currently stand at $15.33B, quite a bit higher than the Street’s consensus of $14.93B, projecting growth of 11% from the year-ago period.

What to watch: If one trend is clear this earnings season, it’s that having ties to the blockbuster hit movie Star Wars: The Force Awakens, is great for a company’s bottom-line. Thus far, Electronic Arts (EA) and Hasbro (HAS), both of which sell popular Star Wars products, have reported impressive earnings for the quarter. Disney should be no exception as the producer of the film that has collected more than $2B worldwide. Their parks & resorts division is also set to open Star Wars themed attractions. The hope is that the success of the film should be enough to offset Disney’s slumping television business. Shares of Walt Disney have tumbled 22% in the last 3 months, in most part due to the fact their crown jewel, ESPN, comes under considerable pressure. ESPN has struggled to stimulate subscription growth as consumers transition from traditional cable packages to online TV content. The widespread adoption of mobile content has lost ESPN 3 million subscribers in fiscal 2015 alone.

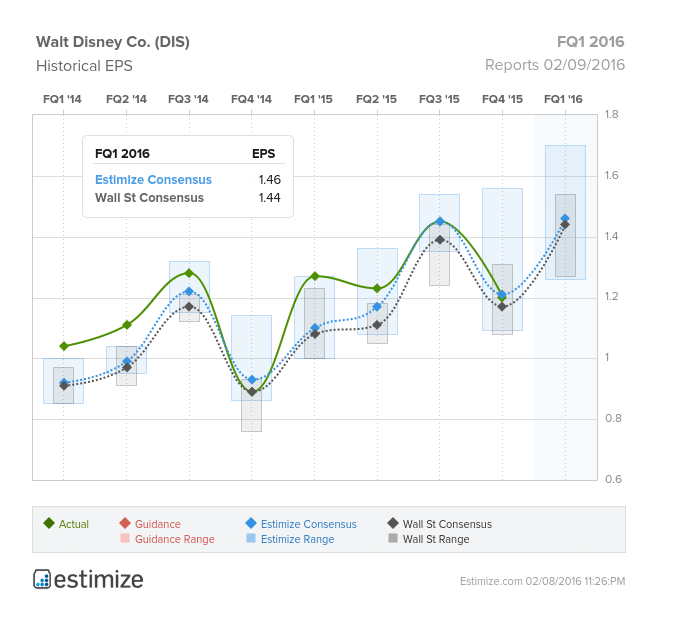

Tesla Motors, Inc. (TSLA)

Consumer Discretionary – Automobiles | Reports February 10, after the close.

The Estimize community calls for EPS of $0.04, 4 cents higher than Wall Street while revenue estimates of $1.8B are right in line with the Street. The Estimize community has been bearish on Tesla’s profitability, moving EPS estimates down 58% this quarter, but still expecting impressive YoY growth of 130%. On average Tesla has only beaten the Estimize EPS consensus 33% of the time.

Leave A Comment