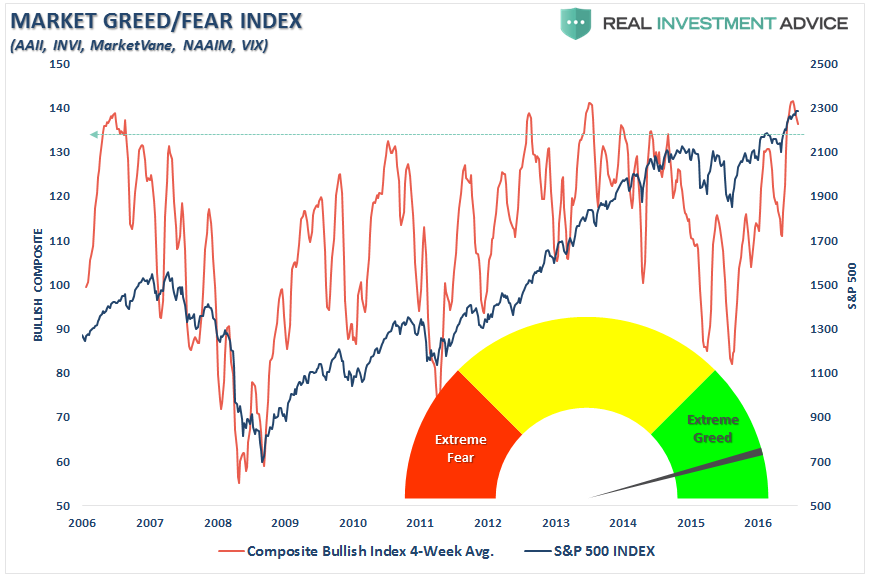

There is little doubt currently that complacency reigns in the financial markets. Nowhere is that complacency more evident than in the Market Greed/Fear Index which combines the 4-measures of investor sentiment (AAII, INVI, MarketVane, & NAAIM) with the inverse Volatility Index.

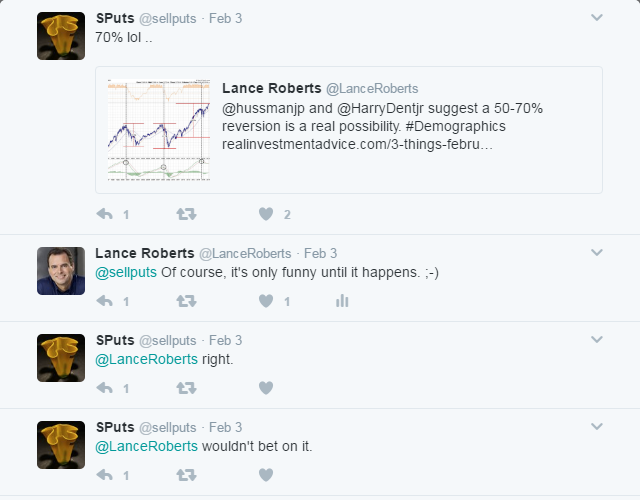

The reason I revisit the index above is due to last Thursday’s “3-Things” post in which I presented two arguments concerning the potential for a 50-70% decline in the markets. John Hussman’s view was simply a valuation argument stating:

“To offer some idea of the precipice the market has reached, the median price/revenue ratio of individual S&P 500 component stocks now stands just over 2.45, easily the highest level in history. The longer-term norm for the S&P 500 price/revenue ratio is less than 1.0. Even a retreat to 1.3, which we’ve observed at many points even in recent cycles, would take the stock market to nearly half of present levels.”

The second argument was from Harry Dent based on demographic trends within the economy as the mass wave of “baby boomers” become net-distributors from the financial markets (most importantly draining underfunded pension funds) in the future. To wit:

“At heart, I’m a cycle guy. Demographics just happens to be the most important cycle in this modern era since the middle class only formed recently — its only been since World War 2 that the everyday person mattered so much; because now they have $50,000-$60,000 in income and can buy homes over 30 years and borrow a lot of money. This was not the case before the Great Depression and World War 2.

And based on demographics, we predicted that the U.S. Baby Boom wouldn’t peak until 2007, and then our economy will weaken — as both did in 2008. We’ve lived off of QE every since.”

Not surprisingly, those two comments drew a lot of fire from readers such as this one:

Or this one…

@hussmanjp and @HarryDentjr suggest a 50-70% reversion is a real possibility. #Demographics https://t.co/3jAfPH0I88 pic.twitter.com/zdOWhfA6z9

— Lance Roberts (@LanceRoberts) February 2, 2017

@LanceRoberts @hussmanjp @HarryDentjr central banks will step in before it even reverts 20%. #printingpress

— Paul Nguyen (@Saucerys) February 4, 2017

Hmmm….where have I heard this before.

“Stock prices have reached what looks like a permanently high plateau. I do not feel there will be soon if ever a 50 or 60 point break from present levels, such as they have predicted. I expect to see the stock market a good deal higher within a few months.”

– Dr. Irving Fisher, Economist at Yale University 1929

Leave A Comment