Parker-Hannifin (PH) is a high quality industrial business with entrenched market positions and excellent cash flow generation. The company has increased its dividend for 59 consecutive years, making it a Dividend King, and offers a 2.8% dividend yield today. Its dividend has also compounded at a double-digit annual rate over the last decade and should continue putting up above-average growth, making it a good fit for our Long-term Dividend Growth portfolio.

The strong dollar and sluggish industrial activity around the world are challenging the business today, but we don’t believe these issues affect PH’s long-term earnings power.

Business Overview

PH is a global leader in motion and control technology – anything that enables motions (e.g. hydraulics, mechanical pneumatics controls, etc.) or controls the flow of fluids or gases (e.g. pumps, valves, filters, etc.). Its precision engineered solutions serve roughly 445,000 customers in virtually every significant manufacturing, transportation, and processing industry.

Business Segments: Diversified Industrial North America 45%, Diversified Industrial International 37%, Aerospace Systems 18%. Note that roughly 50% of PH’s industrial sales are from high-margin aftermarket business, which is also much less volatile than OEM revenue.

Technology Platforms: Flow & Process Control 32%, Motion Systems 28%, Filtration & Engineered Materials 22%, Aerospace Systems 18%.

Business Analysis

PH is the number one player in a fragmented $120 billion market, which provides plenty of room to grow organically and through acquisitions. The company has about 20% share in the markets it competes in and possesses profitability metrics that are in the top quartile compared to its peers.

Of course, the company has many competitive advantages. PH has the broadest technology platform in the market, allowing it to help customers create more systems and subsystems than any of its competitors. While most competition competes on one or two technologies, about 60% of PH’s customers buy from four or more of its seven operating groups.

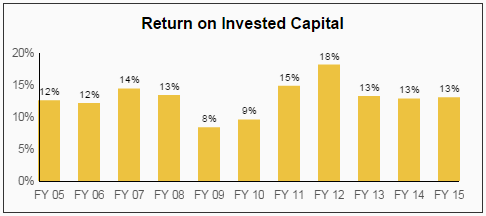

Most of these technologies have patents or trade secrets protecting them and focus on mission-critical parts of the products they go into. By focusing on high-margin niches and offering a greater breadth of protected technologies, PH is able to maintain strong returns on invested capital.

Source: Simply Safe Dividends

While PH’s returns are somewhat cyclical, its meaningful maintenance, repair, and overhaul (MRO) business provides a strong source of stability and entrenchment with customers. MRO accounts for 50% of PH’s industrial sales and carries much higher margins than the overall business. Unlike OEM parts, aftermarket parts and services are necessities when equipment wears down, making the MRO business less cyclical.

Leave A Comment