Johnson & Johnson (JNJ) is one of only two companies to hold the coveted AAA credit rating from Standard & Poor’s. The other is Microsoft (MSFT ).

This stellar credit rating is a testament to the strength and stability of Johnson & Johnson’s business model.

The company has delivered strong shareholder returns over the years, driven by steadily increasing dividend payments. In fact, Johnson & Johnson is one of the most popular dividend growth stocks among dividend growth bloggers.

Johnson & Johnson is also a Dividend Aristocrat, an elite group of companies with 25+ years of consecutive dividend increases.

This post will discuss the many reasons why Johnson & Johnson holds a perfect credit score from S&P.

Just How Good is AAA?

For investors that aren’t familiar with S&P’s credit ratings, it can be hard to appreciate just how rare Johnson & Johnson’s perfect credit score is.

Before diving into Johnson & Johnson’s company-specific credit factors, I wanted to provide a baseline.

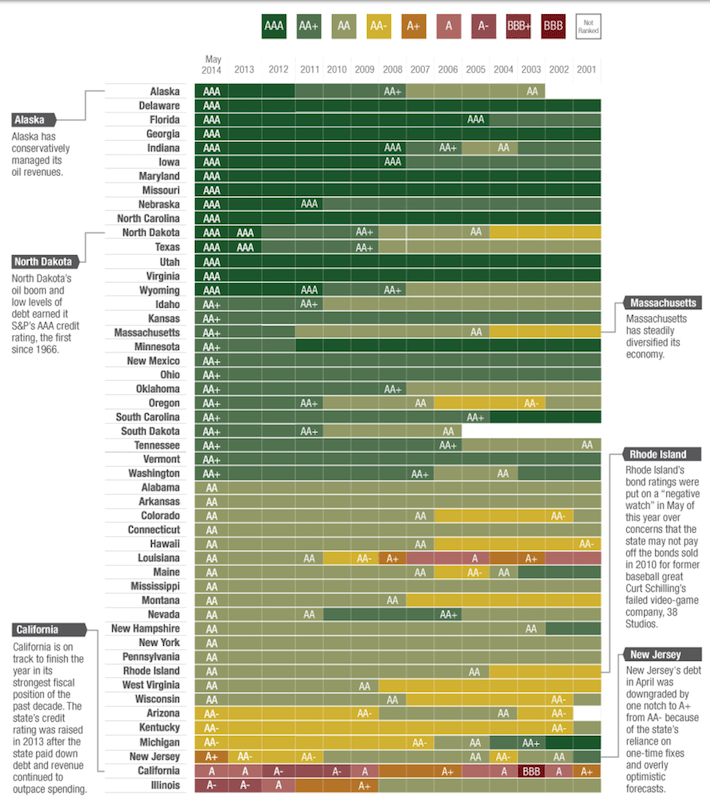

The following diagram displays the credit ratings of the 50 American states and how they have changed over time.

Source: The Pew Charitable Trusts

Note that there are only 15 states with a AAA credit rating. Moreover, the United States Federal Government has a credit rating of AA+ from S&P, which indicates that the ratings agency has more faith in Johnson & Johnson’s ability to repay debt than they do in the domestic government.

Think about that for a second… Rating agencies have more faith in Johnson & Johnson to pay its debt than the United States government – and the government has the ability to tax.

In the past, there were many more AAA-rated companies in the United States. The number has slowly trickled down over time. This trend can be seen in the following diagram.

Source: qz.com

Johnson & Johnson and Microsoft became the last two companies to hold the AAA credit rating when Exxon Mobil (XOM) was downgraded to AA+ on April 26, 2016.

The ratings agency cited concerns about low oil prices which led to deteriorating cash flow and rising leverage for the oil and gas supermajor.

Johnson & Johnson is considered more creditworthy than the federal government, all but 15 states, and all but 1 other company. Clearly, this AAA credit rating is rare– now let’s examine why Johnson & Johnson holds this coveted classification.

Johnson & Johnson Business Overview

Johnson & Johnson is a massive healthcare conglomerate with more than 260 subsidiary companies.

Leave A Comment