Some investors believe in maintaining the use of old models because they have historical precedence; new ideas can be risky to try. One example which comes to mind is when the 1990s tech firms were valued based on eyeballs instead of earnings. Believing in new models can easily turn into justifying overpaying for an asset. However, don’t avoid using new metrics just because there are others which have failed. Valuation is very difficult, but it is profitable if you get it right. Putting your head in the sand and assuming all companies should be valued the same will cause you to miss out on investing in the most innovative companies. At the same time, valuing firms based on their ideas involves too much euphoria.

Tech Changes Everything

It’s clear that the sector driving change in how business is understood is technology. However, it’s not only those firms. With the proliferation of technology, every successful company is utilizing the internet and software to drive productivity and sales. You can’t avoid investing in these types of companies because you’ll end up picking laggards which are stuck in the past. Earnings will always matter when investing, but there’s more to forecasting earnings than reviewing the bottom line. You need to understand how firms get to the bottom line. This understanding involves both valuations and economics because of changes in how businesses operate also effects how people decide to spend their money. Economics is the study of how people and businesses allocate resources.

Software Has Low Variable Cost

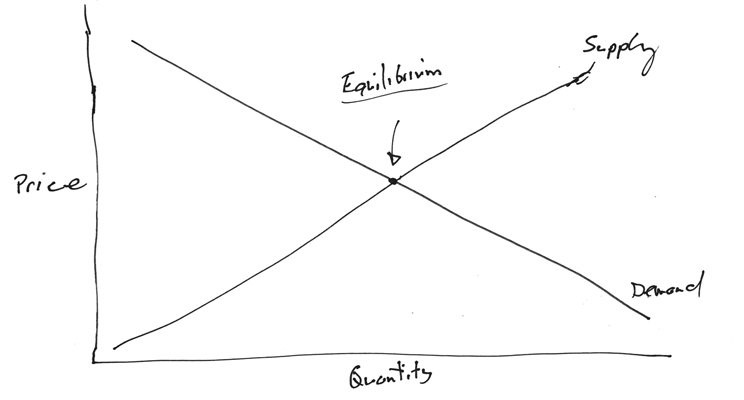

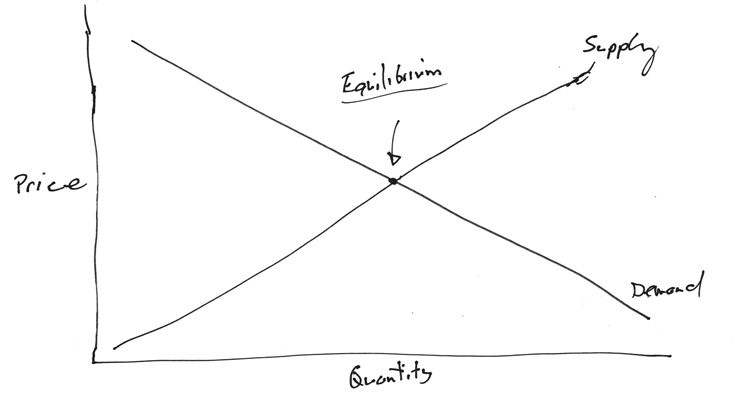

The chart below was posted on Twitter by Bill Gates.

Source: Gates Notes

It’s a basic supply and demand curve which shows how price and quantity are affected by supply and demand. This chart is still taught in basic economics courses, but software has disrupted how these curves work. Software eliminates variable cost which is revolutionary. When a firm sells a product or service, there are fixed costs to create what is going to be sold and then there are variable costs to keep the business running. Software almost eliminates the upkeep variable cost. The supply curve for an intangible asset is almost flat at the price of the first product produced because of this low variable cost.

Leave A Comment