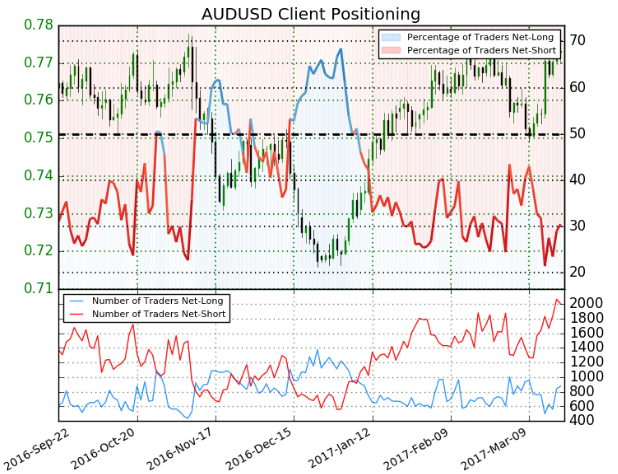

AUDUSD Daily

Technical Outlook: AUDUSD is probing a key resistance range we’ve been tracking for the past few months at 7735/56– this region is defined by basic trendline resistance, the 88.6% retracement of the April decline & the 2016 high-day close and has continued to cap rallies in Aussie since August. The focus is on this key range heading into the close of the month with a close above needed to mark a more significant breakout opportunity in the pair. That said, the immediate advance remains at risk while below this threshold with interim support seen at the monthly open 7656.

AUDUSD 120min

Notes:A look at the intraday chart highlights a near-term slope originating off the monthly lows with the weekly opening range now taking shape just below the 7735/56 resistance zone- look for the break with a move sub-7651/56 needed to mark a more meaningful correction in the pair. Such a scenario targets subsequent objectives at 7620 & 7591. Broader bullish invalidation rests at 7542/47 (3/3 swing low / 200-day moving average).

A breach topside breach still has to contend with the November high at 7778– but beyond that, it should be smooth sailing to 7835. From a trading standpoint, I’ll be looking for exhaustion around these levels with a deeper pullback to offer more favorable long opportunities into structural support – the first of which would be the monthly open. Keep in mind seasonal tendencies favor USD weakness (i.e. AUDUSD strength) heading into the start of April trade.

A quarter of the daily average true range (ATR) yields profit targets of 17-22pips per scalp. Most of the event risk this week will come from the USD with the release of the February Durable Goods Orders on Friday highlighting the economic docket.

Leave A Comment