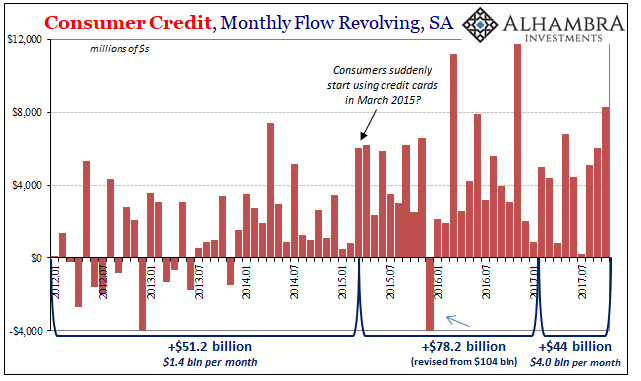

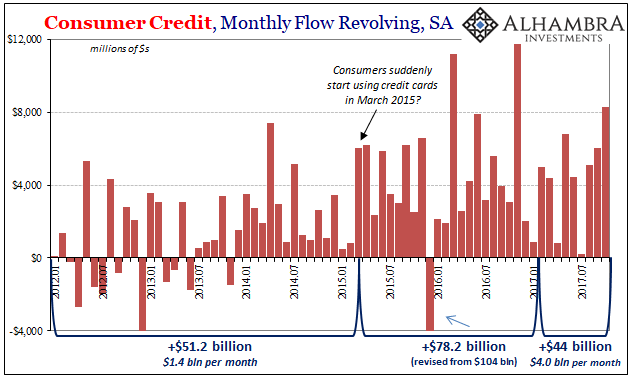

According to the Federal Reserve, US consumers in October added a large $8.3 billion (SA) to their credit card balances. That was the third largest monthly increase since 2007. For some, that’s an indication of risk-taking and therefore recovery-like behavior on the part of American consumers. Given that it’s been this way for some time, revolving consumer credit balances started in earnest around March 2015, and recovery isn’t the term anyone could reasonably use to describe the past three years, that doesn’t seem very likely.

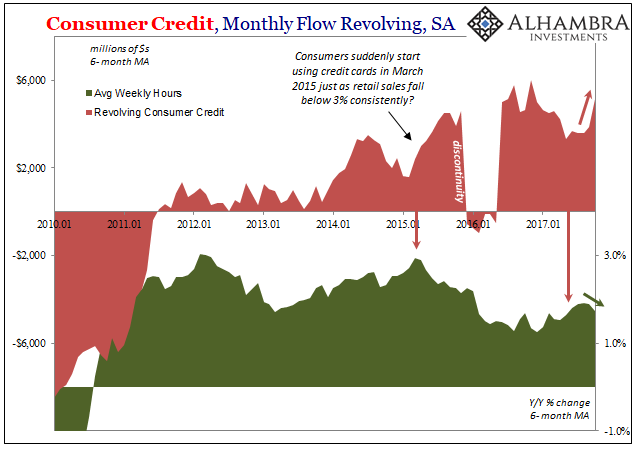

Instead, there has been a pretty good correlation between the rise of revolving credit and the deceleration in the labor market. The BLS’s estimate for total weekly hours, for example, notes a serious slowdown that persisted to the end of 2016. As hours came back up slowly, revolving credit balances began to accumulate more slowly; perhaps the credit cards weren’t needed as much with a little more work available for hire.

But after rebounding somewhat, total hours over the last several months have been retrenching. During those same months, revolving credit has again spiked. What that might mean in real economic terms is at the margins less available work and therefore income, leaving workers little other options apart from giving up on marginal spending.

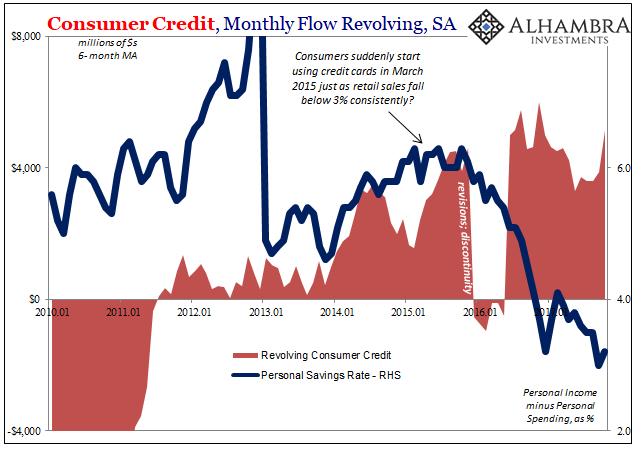

Given that the Personal Savings Rate simply collapsed during that prior period, it does seem to suggest a high degree of consumer/worker strain; pretty much the opposite of what you would expect for a low savings rate/accelerating consumer debt period.

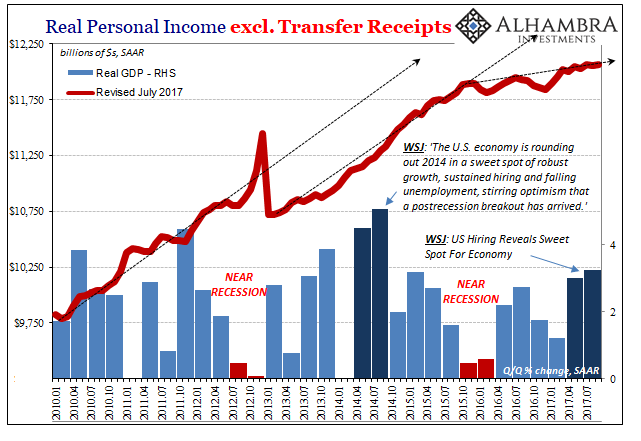

As always, it starts with income growth, or really the continued lack of it. Tomorrow’s payroll report will in all likelihood show that the US economy added about 2.2 million jobs in 2017. That number will be heralded widely and soundly throughout the media and mainstream as some great achievement. It is, in fact, a pretty bad result, a nod to ongoing, unbroken economic weakness even after ten years of it.

Leave A Comment