Maybe there is hope for the media yet. The benchmark 10-year US Treasury bond yield has passed above 2.40% for the first time in several months. In the past any similar move or technical breakout of the like was met with uniform screeching about a BOND ROUT!!! This time, however, commentary appears at least to me much more subdued, perhaps as even the rat given the electric shock eventually figures out in which direction the food lies.

That doesn’t mean there aren’t a plethora of articles expounding on the continued narrative about interest rates and the “only” direction they can travel. It’s been six years of this, so there is no more “only” to that equation but for transitory comments. It won’t stop those committed to the case from still preaching it:

“The moment of truth has arrived for secular bond bull market!” DoubleLine Capital Chief Investment Officer Jeffrey Gundlach tweeted Tuesday, just before yields touched session highs. “Need to start rallying effective immediately or obituaries need to be written.”

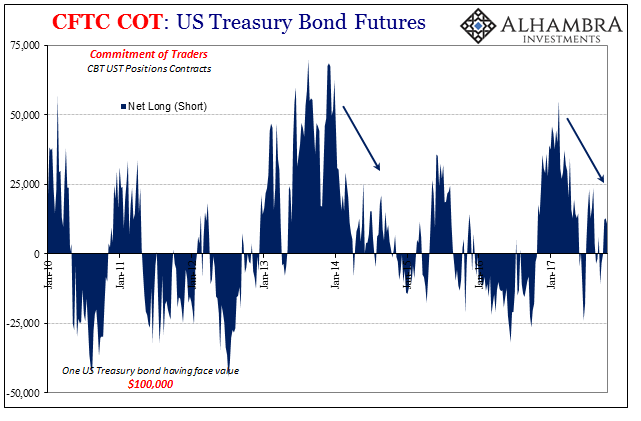

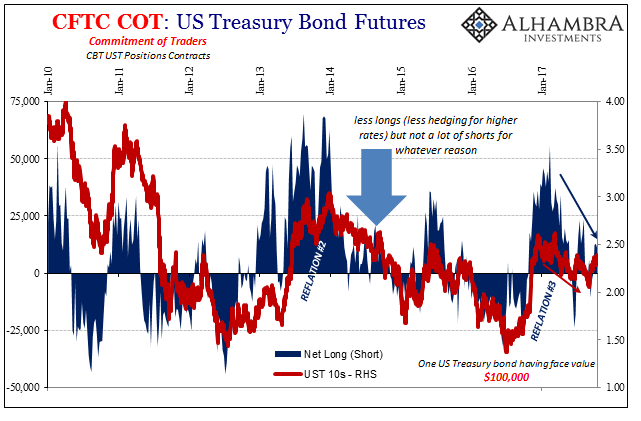

I’ve stopped counting the almost endless string of moment of truths that have come and gone with no truth and fewer moments. With respect to Mr. Gundlach’s point, the market just doesn’t seem to agree. And by market I mean UST futures rather than cash.

In fact, the futures market, which is what really matters, is re-enacting the same behavior as in 2014. Each of these BOND ROUTS!!! following each major “reflation” selloff occur with less and less futures market conviction.

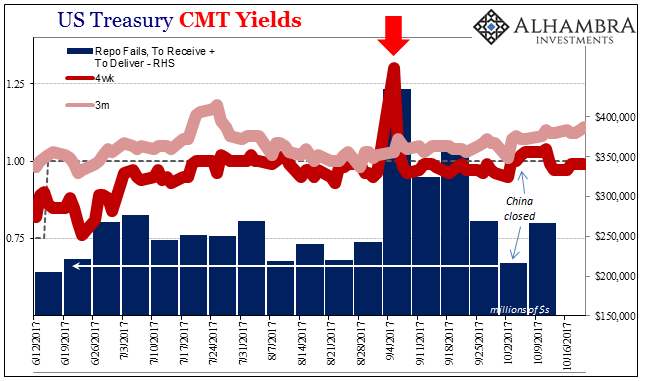

In this latest one, the center of gravity barely shifted to net long, and it did so starting the week of September 5 – when everything else in dollars and “dollars” went nuts. That would seem to indicate a more cautious tone about the market than a significant change in stance.

In fact, the week China reopened from holiday the net futures position in the UST market started sliding back toward short (suggesting a shift back toward a lower rate bias). Even yesterday’s Bloomberg article cited above was careful to note that derivatives positions beyond UST futures aren’t following Gundlach’s advice, either:

Leave A Comment