My Swing Trading Approach

I added one position yesterday in the leading sector, industrials, but only a small amount of my capital is being put to use here, as long as the market remains uncooperative in the short-term.

Indicators

Sectors to Watch Today

Telecom exhibited a lot of strength today, but not necessarily enough to get overly optimistic on the sector. Industrials continues to consolidate at the recent highs and looks poised for a solid break higher. Technology continued with the bounce off of the June lows.

My Market Sentiment

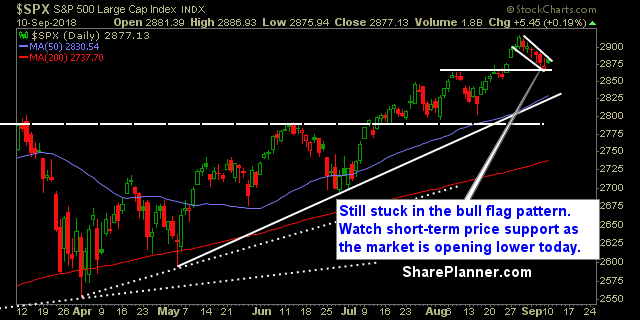

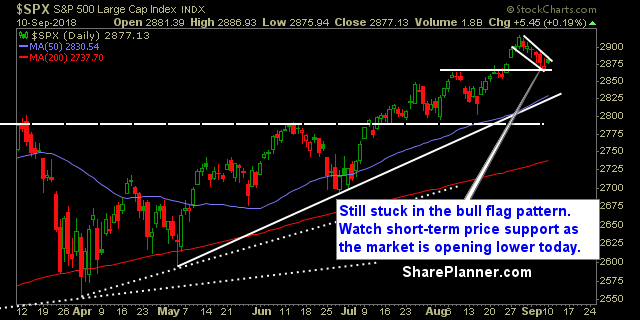

Bull flag pattern still in play, and potential bounce off of the 20-day moving average, though yesterday’s price action wasn’t inspiring. Market poised to gap lower, the key becomes whether the bulls can fill the gap as the market has done a lot of lately.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Leave A Comment