Photo Credit: Scott Beale

Rackspace Hosting, Inc. (RAX) Information Technology – Internet Software & Services | Reports February 16, After Market Closes

Key Takeaways

Despite how fast cloud computing is growing, not all players in the industry are winners. That’s something Rackspace needs to consider as shares of the company have fallen a resounding 65% in the past the past 12 months. The cloud computing specialist has struggled to maintain growth while heavy hitters like Google, Microsoft and Amazon take the industry by storm.

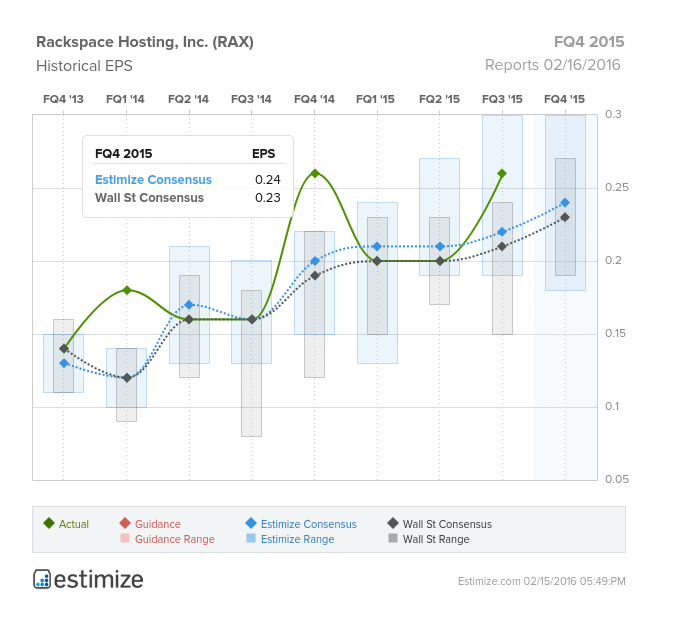

Consequently, expectations are muted for Rackspace’s fourth quarter earnings which will be released February 16, after the market closes. The Estimize consensus is calling for EPS of 0.24, 1 cent higher than Wall Street, and revenue expectations of $522.77 million are roughly $1 million above the Street. Compared to Q4 2014, this represents a projected YoY decline on the bottom line of 3%, while revenue is expected to grow 11%. Despite modest top line growth, stiffer competition continues to weigh heavily on margins.

Just this year, Amazon and Microsoft cut prices of their flagship cloud products to solidify their stance against other major cloud computing suppliers. As you would suspect, Rackspace’s stock reacted negatively to the news, dropping 30.4% since the start of the year. To avoid getting squeezed out by the competition, Rackspace has focused on investments in its services. The company recently launched “fanatical support”, an around the clock managed support service dedicated to serving Amazon Web Services and Azure customers. In the short term, this is expected to offset slumping growth in the overall business, but is not viewed as a long term solution.

Leave A Comment