On the vital matter of missing symmetry, consumer price indices across the world keep suggesting there remains none. Recoveries were called “V” shaped for a reason. Any economy knocked down would be as intense in getting back up, normal cyclical forces creating momentum for that to (only) happen.

In the context of the past three years, symmetry is still nowhere to be found. It’s confounding even central bankers who up until all this have been especially immune to contrary evidence. The unemployment rate tells them what they want, so everything else be damned.

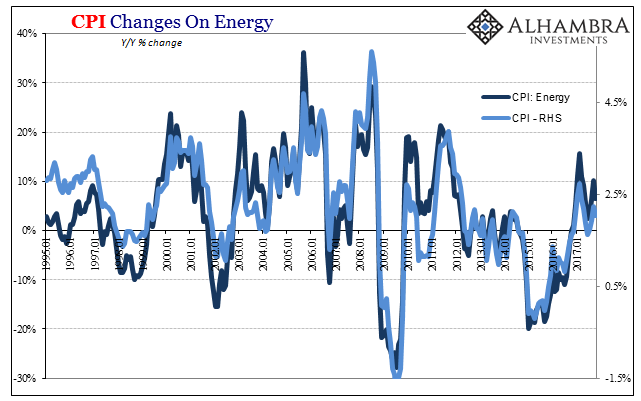

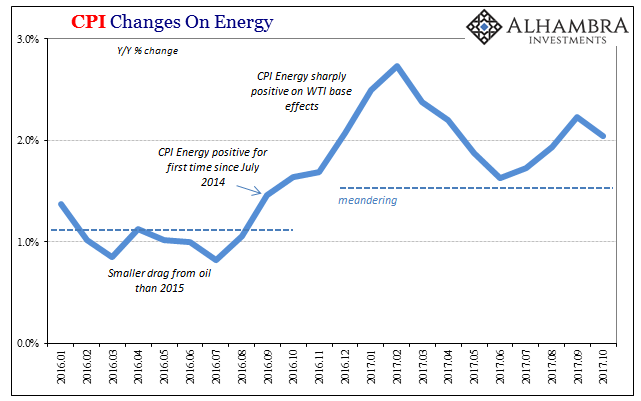

The US CPI in October 2017 rose 2.04% above the index for October 2016. That’s a slight deceleration from 2.23% inflation in September, despite another energy price boost.

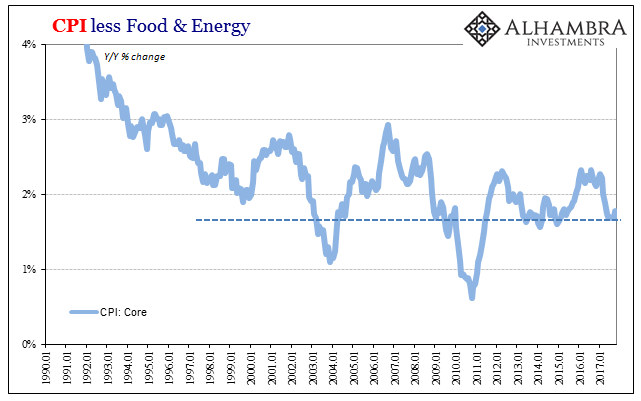

That level of increase continues to be about 2/3 of the Fed’s explicit, official inflation target. Since the central bank uses instead the PCE Deflator as its standard for measuring and evaluating consumer price changes, a ~3% CPI calibrates (approximately) to a ~2% PCE Deflator (when inflation peaked in July 2008 the CPI was at 6%, the PCE Deflator 4%; earlier this year, the former registered 2.74% at the peak in February compared to 2.18% for the latter).

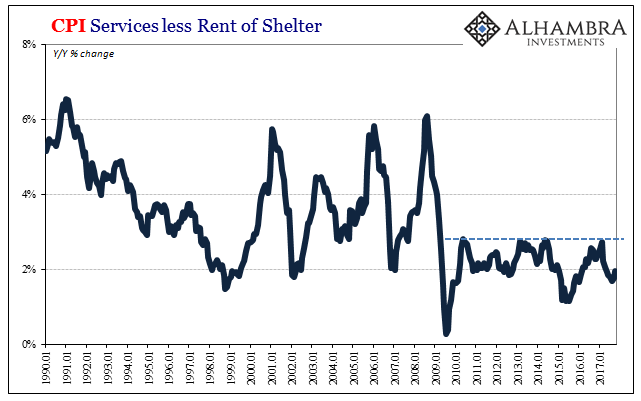

While energy price differences in any given month are largely responsible for the headlines, underneath there is still nothing that would suggest five and half years of price misbehavior is close to ending. The core parts of the index, including Services less Rent, show no signs of economic acceleration or any kind of monetary flow-through from trillions in QE that stopped years ago.

If it was going to happen it would have by now. That’s why the “transitory” excuses are growing thin even for those on the inside. This year has been a huge economic disappointment given what was expected, a result all-too-consistent with the inflation situation deviating for so long from what it “should be.”

Leave A Comment