Lifecos

Although innocent bystanders in the 2008 financial crisis, the life insurance companies were most impacted by the knock-on effects of the fall in equity prices, declines in long-term interest rates, poor credit quality of debt and a general decline in economic activity.

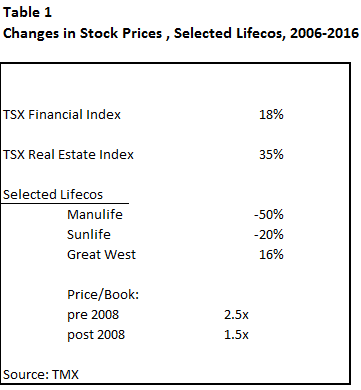

As Table 1 demonstrates, the industry remains permanently ( i.e. long lastingly) impaired. Share prices of the major lifecos are, largely, below pre-2008 levels and/or have not participated in the upswing of equity prices enjoyed by other financial institutions. Major lifecos, such as Manulife and Sunlife, remain well below levels of a decade ago. More importantly,prior to the 2008 crisis, the industry commanded price-to-book valuesof 2.5 times, only to see that metric drop down to 1.5 times today. The industry continues to face a challenge of repairing balance sheets and of tailoring their products to reflect the changes in today`s economic environment.

Above all else, the lifecos have suffered at the hands of today’s low-interest rate world. They are in a constant struggle to matchthe return on assets to the requirements of future liabilities. Re-investing fixed income assets at successively lower rates, in effect, increases the risk of long-term liabilities. In particular, the liabilities most at risk are annuities and guaranteed income products. Low rates also affect reserves and capital margins, necessitating capital infusions to meet industry regulations.

Although the bulk of the industry`s assets are in fixed income, the industry was compelled to seek greater returns from equities and other asset classes– the familiar “stretch for yield”. Many of these other assets groups failed to provide the needed additional returns to offset the declining returns from bonds. For example, Manulife assumed a higher risk profile from the purchase of equities, specifically in the oil and gas sector; the slump in energy prices has hurt profitability. Any mismatch between assets and liabilities leads to profit volatility, a state of affairs that continues to exist.

Persistent low-interest rates are changing the product mix that lifecos offers, for example:

Leave A Comment