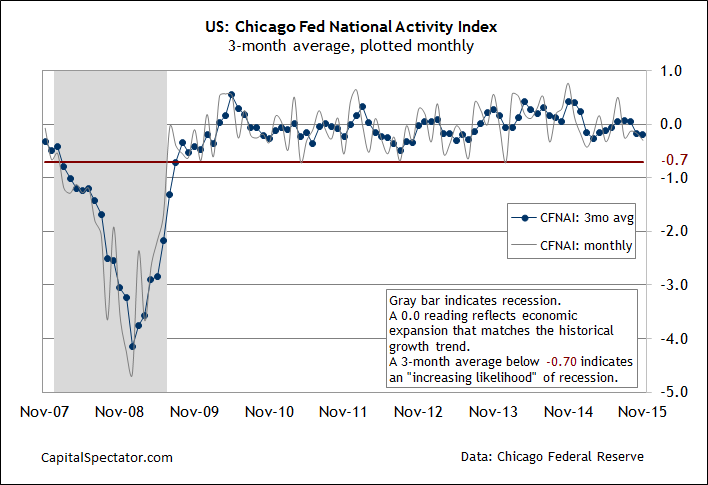

US economic growth in November remained below the historical trend rate for the second month in a row, according to this morning’s update of the Chicago Fed National Activity Index. Revised data for the benchmark’s three-month moving average (CFNAI-MA3) slipped to a negative 0.20 reading last month–down slightly from -0.18 in the previous month and the lowest since March.

Although US economic activity decelerated in November, CFNAI-MA3’s current reading is still above the -0.70 tipping point that marks the start of recessions, according to Chicago Fed guidelines.

Looking at the numbers before averaging, the Chicago Fed National Activity Index’s monthly value weakened to -0.30, the lowest since May. The monthly numbers are noisy, however, which is why the Chicago Fed recommends focusing on the three-month average for monitoring the business cycle. By that standard, the economy is still trending positive, albeit at a relatively subdued pace.

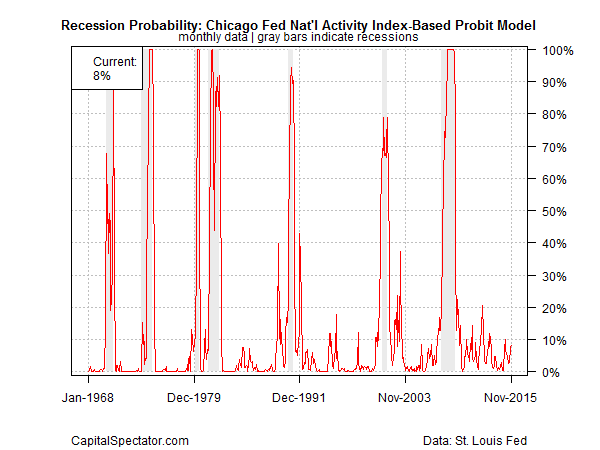

Analyzing the updated CFNAI-MA3 data with a probit model shows that the probability is low (roughly 8%) that a recession started in November. The current risk estimate in the chart below is based on a probit regression that reviews the historical record of NBER’s business cycle dates in context with CFNAI-MA3. The low-recession-risk estimate aligns with last week’s update of business-cycle risk via The Capital Spectator’s proprietary indexes.

Leave A Comment