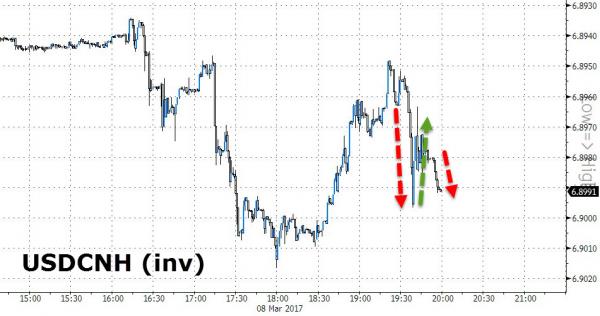

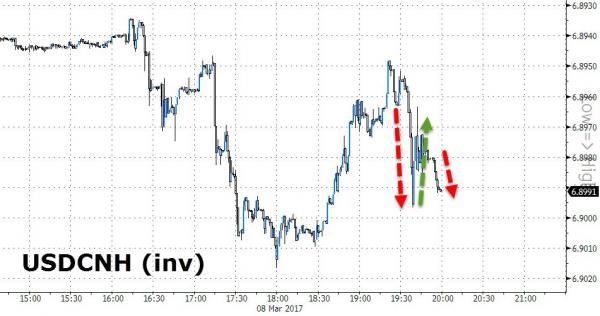

When the headline prints hit tonight on China’s trade data, offshore Yuan dipped and ripped…

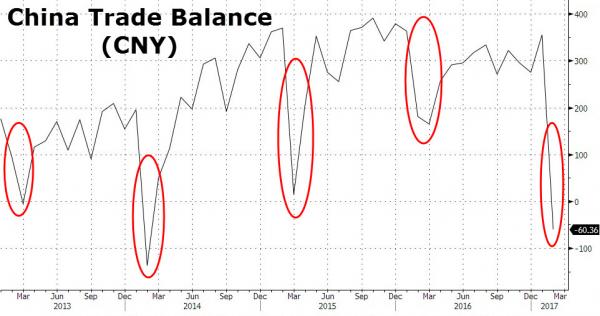

As China faced its first trade deficit in 3 years (-$60bn vs +172.5bn exp)…

Obviously there is some major seaonality…

With imports exploding 44.7% YoY (and exports missing expectations dramatically +4.2% vs +14.6% exp). But it appears the economists forgot about this year’s lunar new year holiday falling in January (vs Feb last year).

As Bloomberg points out, the results were skewed because the week-long Lunar New Year holidays that shutter factories and ports across the nation occurred in February 2016 versus late January in 2017, distorting base year comparisons.

Even though the specific data point is entirely worthless, we note that Imports from U.S. rose 41% to 163.5b yuan in Jan.-Feb., General Administration of Customs says in statement.

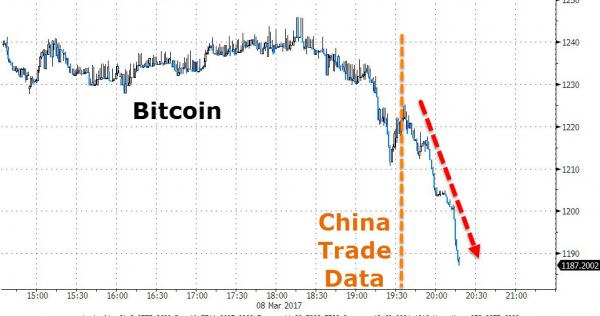

For now it appears Bitcoin is suffering the most post-data (but this could be renewed selling pressure from this morning ahead of this weekend’s ETF decision)

Leave A Comment