January and February economic accounts for China are notoriously difficult to judge because of the non-uniform occurrence of the Lunar New Year. That is why, for example, China’s National Bureau of Statistics doesn’t even bother with industrial production, retail sales or fixed asset investment in those individual months, preferring to combine them together in one release encompassing both January and February so as not to skew any single monthly comparison. Chinese trade figures do not follow that pattern and are released for all calendar months individually. Unfortunately for them, the depth of contraction in February leaves nothing to “seasonal” adjustments. With exports contracting at -25.4%, the holiday week doesn’t even figure so large was the decline.

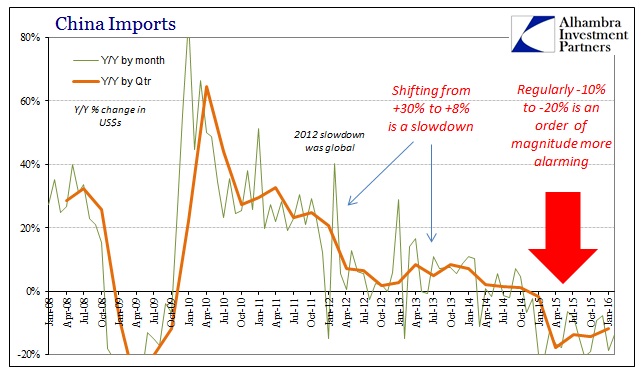

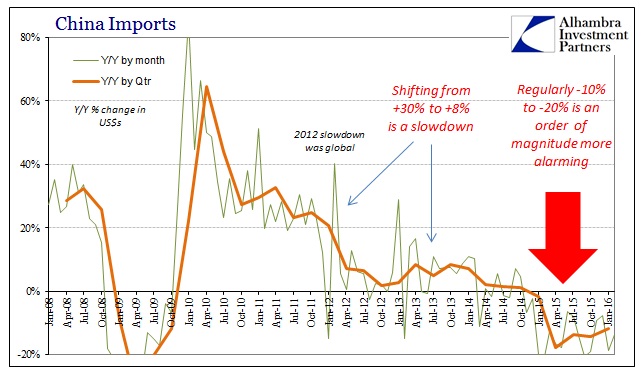

The import side fared little better, with imports dropping another 13.8% and estimated at less than $100 billion for the first time in any month since February 2010. Combining both January and February, imports cumulatively declined 16.6% which only continues the same contraction trend that dates back to late 2014 no matter how much “stimulus” from fiscal or monetary agents. There is no reviving Chinese “demand” for materials, which begins to explain why countries like Brazil are facing depression.

If there is a problem with Chinese “demand”, and there clearly is, then it can be traced to the export sector which has been the bedrock of the Chinese “miracle” all throughout the eurodollar age. It was the eurodollar system’s ascent that financed these growth rates on both sides (consumers and producers), so without the eurodollar push there is no global “demand” to keep it all going.

China’s poor data fit with trade results from other exporters in the region. Last month, Taiwan’s exports fell for the 13th-straight month—the island’s longest export slump since the global financial crisis—while South Korean exports declined for the 14th consecutive month. China’s February results were the weakest since May 2009, when exports fell 26.4%.

Sun Sandy, sales manager at Yancheng Shunyu Agricultural Machinery Co. in the eastern city of Yancheng, said the global environment has made it tougher to export the firm’s tractor parts to Europe, the U.S., Africa and Southeast Asia.

“Exports aren’t doing well right now,” she said. “We’re really hoping for some sort of breakout.”

Leave A Comment