When it comes to high-quality dividend growth stocks, investors naturally gravitate to blue chips like dividend aristocrats and dividend kings. After all, no company can increase its dividend for at least 25 or 50 years in a row without a certain combination of highly admirable characteristics.

These traits tend to include stable and predictable cash flows, strong competitive advantages, good profitability, modest amounts of debt, and of course a very shareholder-friendly corporate culture.

In addition, Warren Buffett, history’s greatest value investor, has made his fortune buying “wonderful companies at a fair price.” So naturally, any company that Berkshire Hathaway (BRK-B) owns a large position in (Coke is 9.5% of Berkshire’s portfolio) is seen as a defacto high-quality blue chip.

While Coca-Cola (KO) does indeed possess many admirable qualities, including 55 consecutive years of rising dividends, that doesn’t necessarily mean that this popular dividend growth stock is a good fit for most income portfolios right now.

Let’s take a look at the pros and cons of Coke to see if its best days are behind it, and more importantly if today’s valuations means investors could be better off not adding the company to a diversified dividend portfolio at this time.

Business Overview

Founded in 1886 in Atlanta, Georgia, Coca-Cola has grown to become the world’s largest drink purveyor and the fifth most valuable brand in the world. It markets over 3,900 products through over 500 brands in more than 200 countries.

In fact, Coca-Cola is so geographically diversified that the US market accounts for less than 20% of its overall sales volumes.

Source: Coca-Cola

The vast majority of the company’s sales and profits come from a strong core of $1 billion+ brands that the company produces in about 900 plants around the world and markets through 24 million global retail outlets.

Source: Coca-Cola

Business Analysis

Coca-Cola is the epitome of a wide moat company, meaning it has numerous competitive advantages that allow it to command strong pricing power. The two biggest advantages are its leading global scale and unbeatable brand strength.

Coke generally spends about 8% of its revenues on advertising around the world, in order to make its products universally known and loved in almost every nation on earth. However, the true power behind Coke’s global beverage empire is owning the largest distribution network on earth.

In the consumer food and beverage market, distribution is everything. Having the best product in the world is meaningless if you can’t get it on the shelf and into the hands of consumers. Coke has spent 132 years and an absolute fortune to build the largest distribution and logistics chain in the industry.

This, combined with its very strong brand loyalty, means that Coke has dominant shelf positions in over 24 million retail outlets around the world. This giant reach also allows the company to achieve impressive economies of scale, which lead to above average margins and impressive free cash flow to consistently pay higher dividends.

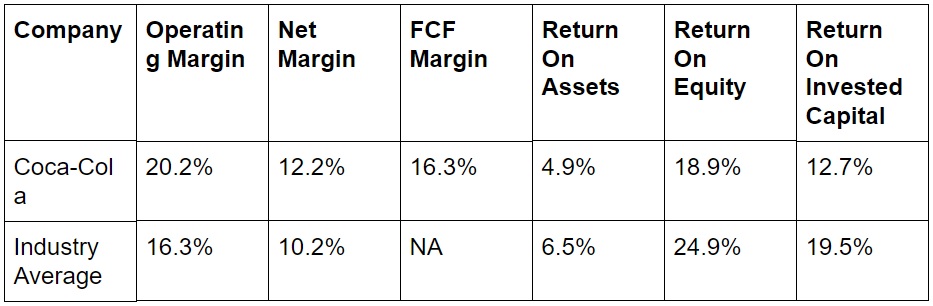

Coca-Cola Trailing 12-Month Profitability

Source: Morningstar, Gurufocus, CSImarketing

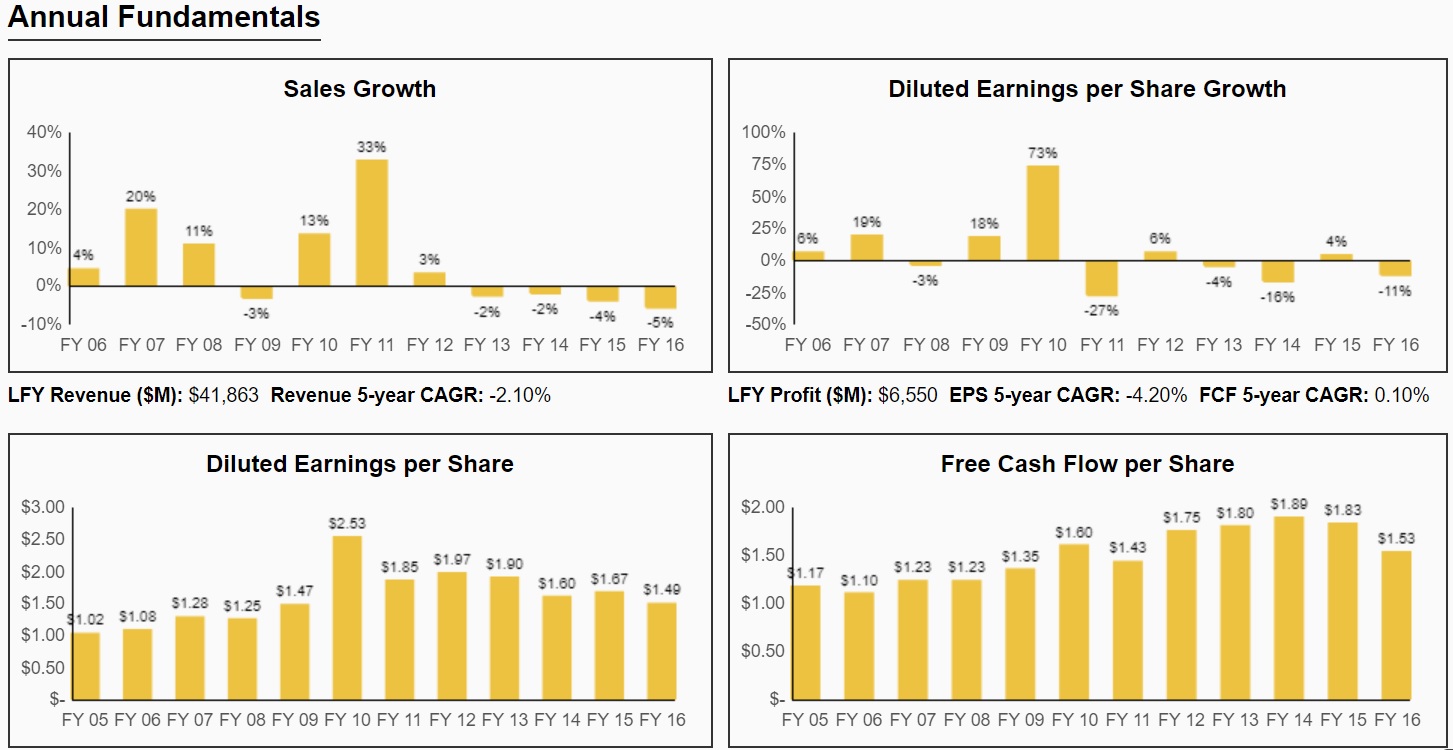

Of course, long time Coke shareholders know that the past few years have not been easy for the beverage giant. Sales and earnings have actually been in decline because of several factors, including declining soda volumes, negative currency effects (more on this later), and the company’s major strategic shift.

Source: Simply Safe Dividends

Specifically, Coca-Cola plans to become a much more profitable company by refranchising its bottling operations around the world.

Source: Coca-Cola Investor Presentation

Coke’s plan is to sell its bottling operations (other than the super high-margin concentrate business) to its current global partners. The logic behind this is that it will make the company much less capital intensive and send margins and returns on capital soaring.

Coca-Cola North American Bottling Refranchising Plan

Source: Coca-Cola Investor Presentation

Management expects that, starting in 2019 when the global bottling refranchising plan is complete and it finishes its $3.8 billion cost cutting initiative (from 2016 to 2019), the company’s operating margins will rise from 22% to 35%.

Of course, cost cutting and financial engineering may boost profitability substantially, but ultimately Coke needs to grow its sales, earnings, and free cash flow if its dividend is to continue growing as it has every year since 1962. Fortunately, Coke also has a plan for how to not only maintain its market share but even grow it, just like it has for many decades.

Source: Coca-Cola Investor Presentation

The first step is the continued transition from Coke’s namesake soda brands into trendier alternatives, such a: bottled water, juices, milk, energy drinks, and teas. Coke plans to devote about 50% of its resources to growing this side of its business.

Source: Coca-Cola Investor Presentation

Specifically, Coke has been very good at making bolt-on acquisitions of fast-growing non-soda brands, such as its recent acquisitions of:

Leave A Comment