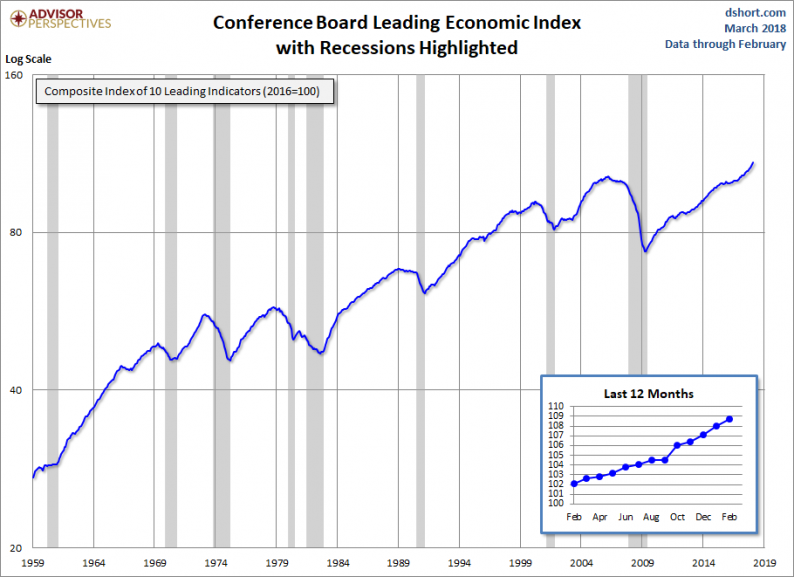

The latest Conference Board Leading Economic Index (LEI) for February increased to 108.7 from 108.0 in January. The Coincident Economic Index (CEI) came in at 103.3, up from the previous month.

The Conference Board LEI for the U.S. increased for the fifth consecutive month in February, fueled by positive contributions from most of the components except for building permits and stock prices. In the six-month period ending February 2018, the leading economic index increased 4.0 percent (about an 8.2 percent annual rate), faster than the growth of 2.4 percent (about a 4.8 percent annual rate) during the previous six months. In addition, the strengths among the leading indicators remained very widespread.

The Conference Board CEI for the U.S., a measure of current economic activity, also increased in February. The coincident economic index rose 1.5 percent (about a 3.0 percent annual rate) between August 2017 and February 2018, almost twice the growth of 0.8 percent (about a 1.6 percent annual rate) for the previous six months. Also, the strengths among the coincident indicators have remained very widespread, with all components advancing over the past six months. The lagging economic index continued to increase, but at a slightly higher rate than the CEI. As a result, the coincident-to-lagging ratio declined slightly. Real GDP expanded at a 2.5 percent annual rate in the fourth quarter of 2017, after increasing at a 3.2 percent annual rate in the third quarter. [Full notes in PDF]

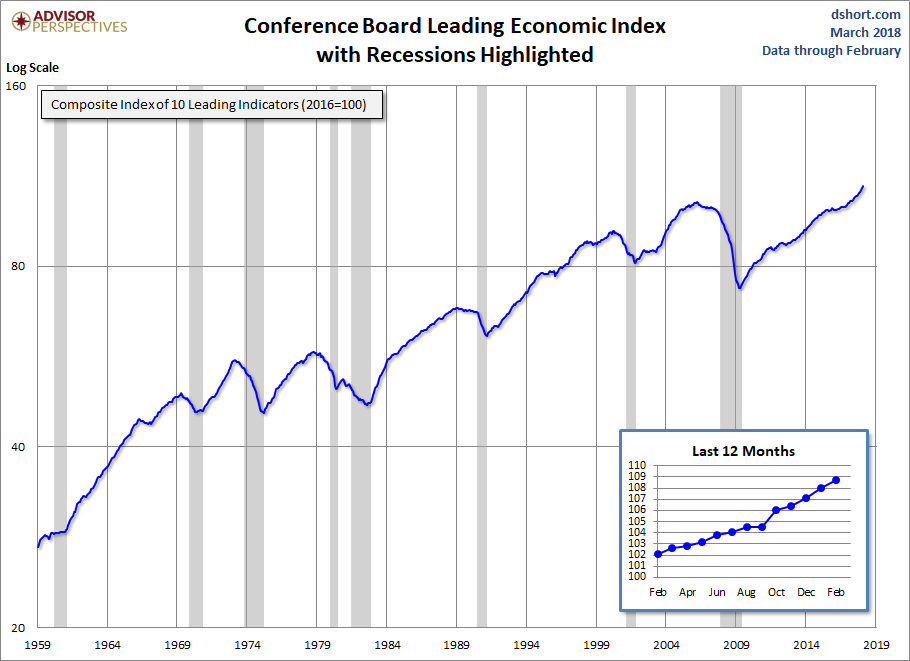

Here is a log-scale chart of the LEI series with documented recessions as identified by the NBER. The use of a log scale gives us a better sense of the relative sizes of peaks and troughs than a more conventional linear scale.

For additional perspective on this indicator, see the latest press release, which includes this overview:

“The U.S. LEI rose again, despite a sharp downturn in stock markets and weakness in housing construction in February,” said Ataman Ozyildirim, Director of Business Cycles and Growth Research at The Conference Board. “The LEI points to robust economic growth throughout 2018. Its six-month growth rate has not been this high since the first quarter of 2011. While the Federal Reserve is on track to continue raising its benchmark rate for the rest of the year, the recent weakness in residential construction and stock prices – important leading indicators – should be monitored closely.”

Leave A Comment