Today started out very badly for the FOMC. At 8:30am the Commerce Department reported “unexpectedly” weak retail sales while at the very same time the BLS published CPI statistics that were thoroughly predictable. Markets, at least credit and money markets, have gained a clearer idea what the Fed is actually doing and why. It’s not at all what the media suggests.

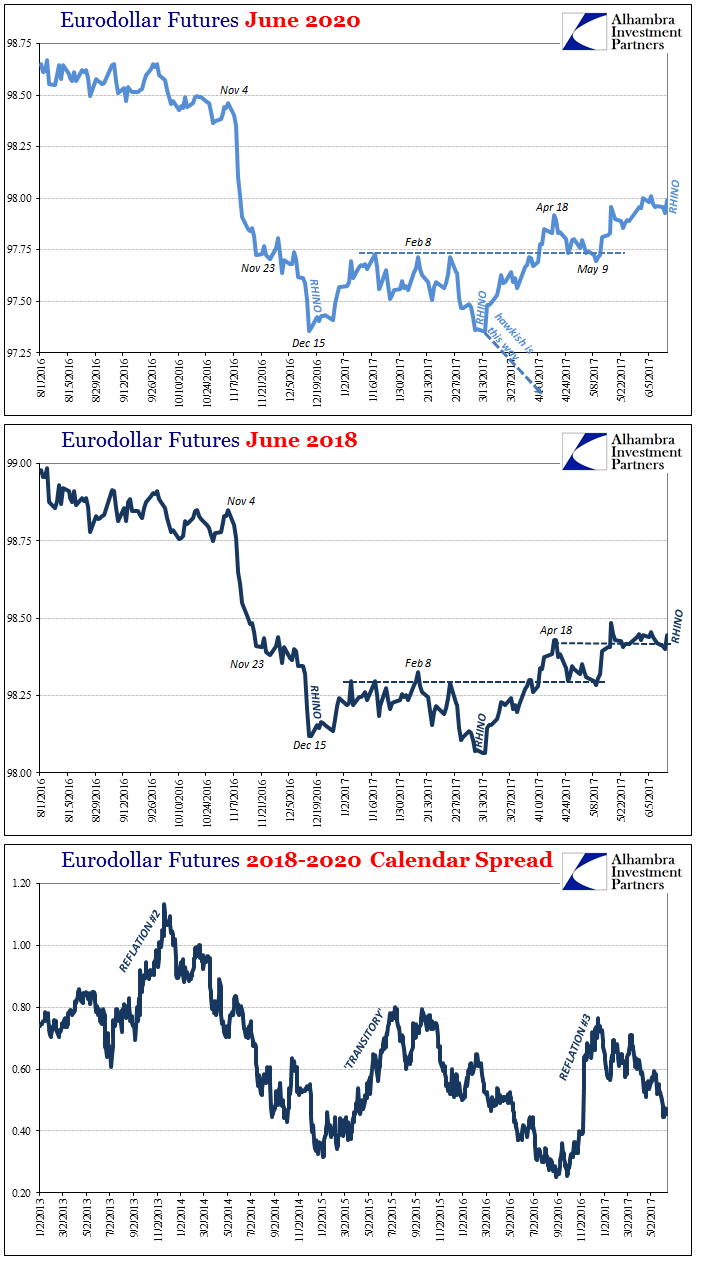

Since everything trades off JPY, the one chart above captures the reaction very well. On a day when the Federal Reserve, Alan Greenspan’s old haunt, raised the federal funds corridor, it was the opposite all throughout the financial markets. Eurodollar futures, which are supposed to match policy expectations, instead have traded directly against them. Since March 15, the last RHINO, eurodollar futures have been enormously bid. It’s 2015 all over again, at least in this one aspect.

Nothing really has changed since then, which is the whole point. The Fed is raising rates not because the unemployment rate is so low which means the economy is about to get so good. Rather, it is thinking about all its various exits because the unemployment rate is so low and the economy never changed. What did change is official belief about that one expectation; throughout 2014 and 2015, they believed the economy was poised to take off, where risks would be rebalanced toward “overheating.” Instead, they’ve been left to talk about wage acceleration all this time without any, as revealed yet again by inflation figures.

According to business contacts in a number of Districts, many firms looking for new workers said they had been raising wages selectively to attract them; some had also begun to raise wages more generally.

That quote wasn’t plucked out of the policy statement issued today accompanying the latest RHINO, rather it was pulled from the meeting minutes of the June 2015 gathering. That one was supposedly “hawkish” and therefore more like this one that actually voted for an increase, yet the justification is somehow still the same. There are but “signs” that wages will accelerate. There are always signs.

Leave A Comment