Photo Credit: erikleenaars

FedEx Corporation (FDX) Industrials – Air, Freight & Logistics | Reports March 16, After Market Closes

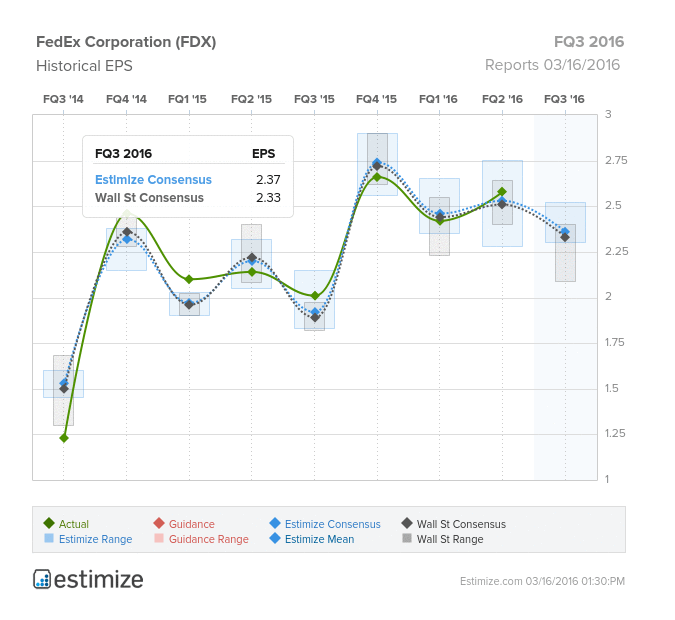

In recent years, it has been unclear what to make of Fedex’s (FDX) earnings given its ups and downs. Last quarter, the global delivery service trounced expectations which only covered up that they’ve missed in 2 of the past 3 quarters. Investors have responded negatively to all this movement and have sent shares falling 17% in the past 12 months. FedEx expects the strong holiday season from online retailers to carry strong delivery and revenue growth in its FQ3 earnings report. The Estimize consensus is calling for EPS of $2.37, 4 cents above Wall Street, and revenue expectations of $12.32 billion, roughly $65 million higher in sales. Compared to the year prior, this predicts as a an 18% increase on the bottom line while sales are looking to grow by 6%. On average, FedEx perineally beats earnings expectations, trumping Wall Street in 69% of reported quarters. As FedEx expands its capabilities and the economy bounds, Fedex should begin to stabilize earnings in the near future.

FedEx currently operates in four key segments led by its FedEx Express and Ground segments. The two divisions are the biggest drivers of revenue making up 85% of the company’s sales. Between robust growth from FedEx Express and Ground and weak prices, FedEx is in store to reverse to spark a string of positive momentum. Moreover, FedEx is expanding its capabilities to more effectively compete with rivals like UPS and DHL that hold a large stranglehold in Europe. Its acquisition of international courier service, TNT Express earlier this year puts FedEx in position to expand its global footprint. Investors should also look for signs of a turnaround in its freight business. The freight business has been FedEx’s weakest spot in the past few quarters but now the company is beginning to align its expectations in this segment with the changing demand. Amazon’s recent emergence in air cargo poises a minimal threat to FedEx and its peers in the near future.

Leave A Comment