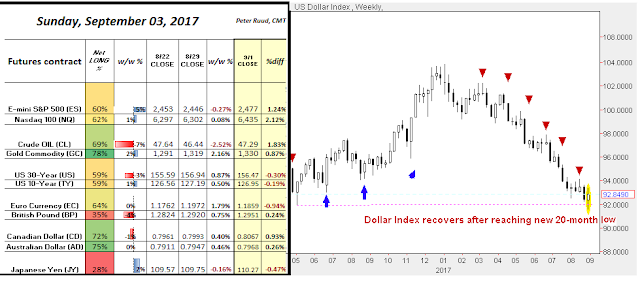

While it was a dull week for FX futures positioning heading into (August) month-end, it was a much more interesting story in how the US dollar managed to overcome another spike down to fresh (20-month) lows on Monday, and then Friday’s disappointing (US) jobs report. After what seemed like such a bleak start to last week, the Dollar Index (DX) actually finished modestly higher, not only highlighting bullish technical divergence (daily RSI), but hinting of a temporary base for the oversold greenback.

The latest Commitment of Traders (COT) report (as of August 29th) also pointed-out the continued gradual unwind of the popular (Japanese) yen carry-trade amid increased geopolitical tensions and overall nervousness for the US administration’s policies. The recent CFTC data also revealed the sudden nervousness and negativity exuded by Crude oil futures traders heading into the last week of the summer’s driving season and strangely, ahead of knowing the true disastrous impact from Hurricane Harvey . In other developments, US equity indices finished near all-time highs; Gold confirmed a monthly (chart) breakout; and the Loonie (Canadian dollar) finished the week at a 2-year high vs the USD.

FX futures positioning against the US dollar was relatively subdued heading into end of August, despite a rather exciting week in price-action. Data from the latest COT report depicted an exhausted short (US) dollar trade that stalled bearish bets with exception with the Japanese yen. Speculator’s there have been paring back bearish bets against the yen, as the percentage of long positions improved for the 5th straight week. This enabled the net percentage (of long positions) to edge higher to 28%, highlighting an improvement off the recent 2-year low. More importantly, it highlights the gradual reduction of the so-called carry trade that has continued ever since geopolitical tensions between the US & North Korea have begun to escalate.

Meanwhile, according to recent FX trading data, the retail population continues to remain quite bearish of the yen, with roughly two thirds of retail position short. That said, after briefly probing below 108.67, the latest oversold bounce does indeed solidify a base with technical significance in the USD/JPY pair. If a move beyond the key 111.00/33 region materializes, it could re-ignite the yen carry trade back towards the 114 handle. If, however, 110.56 (key Fibonacci retracement) continues to cap price-action, then all bets are off.

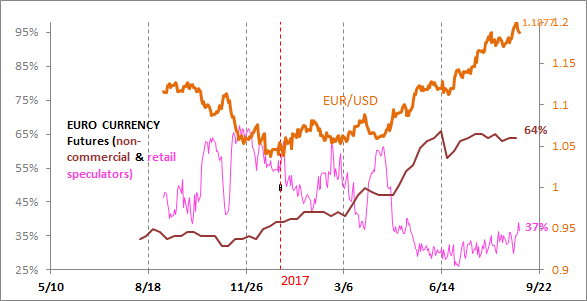

The EUR/USD edged higher into the period covered by the most recent COT report (8/22 to 8/29), as euro bulls briefly broke above the key 1.20 mark for the first time since late 2015. The 10-month improvement in euro positioning has stalled out, however, and could be subject to pulling-back even further given retail traders have seemingly started buying the single currency as of late. That said, the overall trend up in the EUR/USD remains in tact until key support at the 1.17 handle is compromised to the downside.

Leave A Comment