Beware the Ides of March – not the month coming-in like a lion, was our view. For sure, this rally was ridiculously robust (regardless of volume sluggishness in a sense); and that’s because all the resistance areas and moving averages of a short-term nature simply were taken-out.

Those points created acceleration and resulted in a great deal of confusion as to analysis of ‘what’s going on’. No, that’s not an allusion to Trump policies on immigrants, but to the impossible scramble between bulls and bears to sort out what backdrops were supportive or not for the Tuesday rally.

Actually we’ll touch on this a bit via video; but basically it’s almost as amusing as the Jimmy Kimmel take on ‘The Producers’ (below; just couldn’t resist as for anyone with a sense of humor it’s hilarity, regardless of political perspective). In this market you have the upside crowd attributing bad news from China; softer dovish comments from NY Fed President Dudley and a lower Atlanta Fed GDP Now forecast (1.9 from 2.1). Others interpret the post-blizzard recovery as new signs of recovery, and suggested this gives the Fed room to hike rates. Really?

Let’s summarize this as to us it’s a normal intraweek / start of March rally that’s run amok, with dramatic short-covering. I doubt you’re going to see the S&P as well as Oil, the Dollar, and interest rates, all advance in-lockstep for very long.

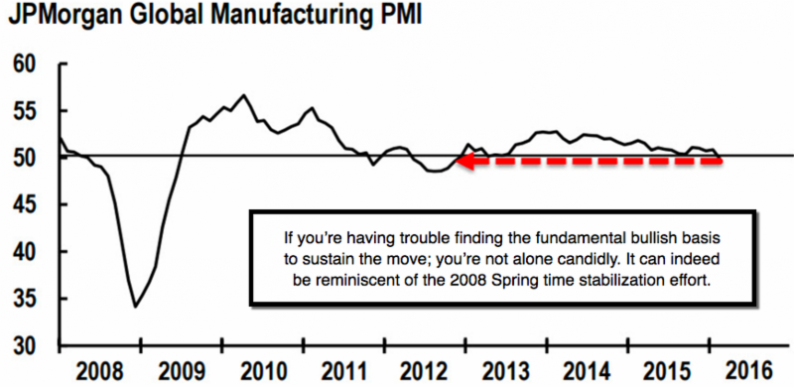

So let’s focus on former Chairman Greenspan’s ‘stark warning’; realize we have a market that’s overbought daily-basis; but not particularly weekly-basis, and as was known coming into this week; a market that short-term had potential either way. Seasonally it’s normal to have strength this time of year; but we all know it is constructed upon a wobbly base; and has as it’s origin a desperate rebound off the double-bottom just above the S&P 1800 level. That doesn’t mean it can’t move up (as I noted that very day when we took more off gains off the table); it means the premise of the move wasn’t there, that’s all. And we wanted higher Oil, with a knowledge that usually that would coincide with higher equities (not on Monday; but it sure did help today… so did the Court decision for Apple that sets a ‘comment’ precedent, if not one based on the terrorist phone issue itself).

Leave A Comment