The bullets were flying on the front lines of the bond market last week. Much of the ordnance whizzing-by were fired by the Fed in the form of Fed member jawboning and decidedly hawkish minutes from the April FOMC meeting. The scuttlebutt is now that the Fed is going to hike in June. Although this is certainly possible, I am not yet ready to sound the all-clear.

Following signs that the U.S. economy has picked up speed from a sluggish first-quarter, Fed officials have begun to sound more hawkish. Even the doves have grown talons. I welcome this change as I believe that the Fed should have lifted-off in late 2014 or early 2015. However, a June hike remains far from certain. Fed officials point to improved data as reasons for the June meeting being live for a possible rate hike. However, economic data also contain signs that Fed tightening might not be imminent or long-lived.

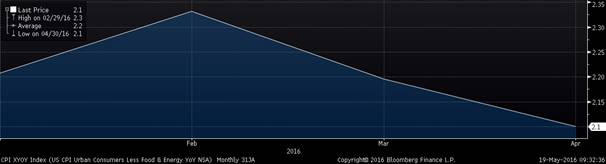

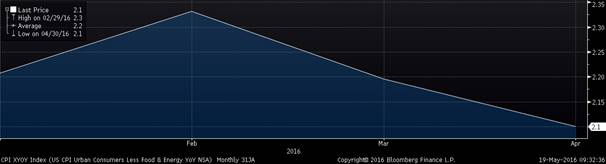

With oil prices rising since bottoming in the middle of February of this year, many (if not most) economists and market strategists have called for broadly rising U.S. inflation. My view has been (and continues to be) that as oil prices rise, consumers with healthier, but still constrained, household balance sheets might rein-in spending (in terms of dollars spent). This would likely result in a convergence of headline and core inflation. In my (oft-stated) opinion, this could materialize in the form of declining core inflation and rising headline inflation. Let’s take a look at CPI data since the beginning of the year.

Core CPI YoY YTD 2016 (Bloomberg):

Headline CPI YoY YTD 2016 (Bloomberg):

I find it interesting that Core PCE reached its near-term peak in February, a time when oil prices fell to their lowest levels since 2002. My hypothesis is that consumers were able to spend and push up prices in discretionary areas of the economy thanks, in large part, to lower fuel prices. As fuel prices climbed, consumers had to make a choice between curtailing spending or to go bargain hunting. I believe that it is no coincidence that the two retailers which reported the best earnings in the most recent quarter were Amazon (shopping destination of the price-conscious tech savvy consumer) and Wal-Mart (shopping destination of the budget-conscious less tech-savvy lower-income consumer). As wage gains have been moderate (at best), consumers were forced to deal with rising fuel prices by looking for cost savings in other areas of their lives. The argument that fuel prices remain low rings hollow with me because it is the journey rather than the destination which drives annual changes to economic data.

Leave A Comment