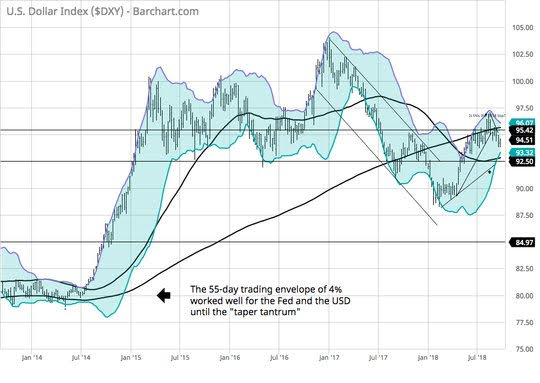

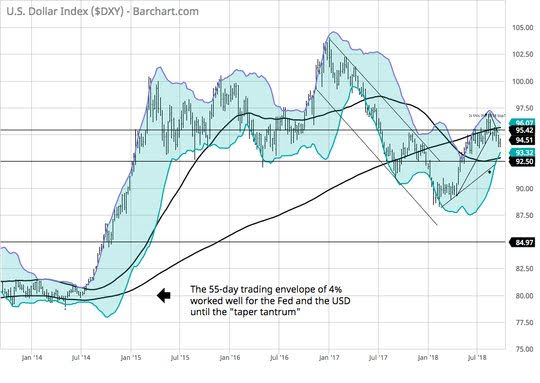

The stick-shift is likely not far from the 8-track tape. Dinosaurs in the history of technology wrapped around transportation and entertainment, but they remain part of the history and culture. Describing neutral was much more straightforward when you had a clutch. Perhaps that is the lesson for the Fed Chair Powell as the removal of the “accommodative stance” phrase sent markets into a overdrive yesterday and that despite a heavy slate of economic data, more central bank decisions and pronouncements, it’s the key driver with a solid second place to the Italian Budget. Latest headlines on Italy are that the coalition parties have agreed on a deficit above 2.0% of GDP, but that Fin Min Tria is holding to a target of 1.6% of GDP under threat of resignation with meetings ongoing today. This leaves the EUR vulnerable and the USD up on the day. The issue for the USD and US bonds rests on how wide neutral rates are to the FOMC – 2-3% is the best guess after the dot plots with consensus for a December hike and 2-3 more in 2019 from the market. The overall mood for a FOMC that bought wiggle room to be slower is surprisingly negative with central bankers clearly underscoring the global uncertainty of trade first and foremost. This puts the C/A and growth of the USD against the rate differentials and path of other central banks as the key for understanding the forecasts for FX but for risk overall, its less clear as a weaker USD is also less reliable as a safe-haven. We are in neutral in trend and with the FOMC meaning a range with 92.50 against 95.50 key.

Question for the Day: Is Asia the risk for 2019? Markets maybe a bit vulnerable to rethinking the consensus views into October with Goldilocks less clear post the FOMC. The view on growth in 2019 also is a risk with many expecting a US slowdown now less sure and with more doubt about Asia next year as trade hopes wane. The FT Focus survey on Asian 2019 growth is a must read for all those in EM looking for a bottom.

The 19 largest economies across emerging Asia will expand by 5.8 per cent in 2019, according to the forecasts collated by FocusEconomics. While this is highly likely to outstrip growth anywhere else in the world, it would represent a slowdown from a projected 6 per cent growth rate this year and would be the weakest reading since 2001, when regional growth fell to 5 per cent as the tech bubble burst.

What Happened?

Leave A Comment