Although small cap stocks have performed reasonably well in 2017, their average return has been lower than that of the large cap stocks in this year (see my article about large cap stock performance).

The Russell 2000 index which represents about 2,000 small cap companies is considered a benchmark for small cap companies which are traded in the U.S. stock markets. The Russell 2000 index has appreciated 13.14% in 2017, besides about 1.33% in dividend yield. That compared to price appreciation of 19.34% and a dividend yield of 1.73% for the Russell 1000 index which represents approximately 1,000 of the largest companies in the U.S. stock markets.

In this article, I will show the best and the worst performers among Russell 2000 stocks this year, and I will show 20 stocks which have a chance to perform well in 2018.

Best Performers

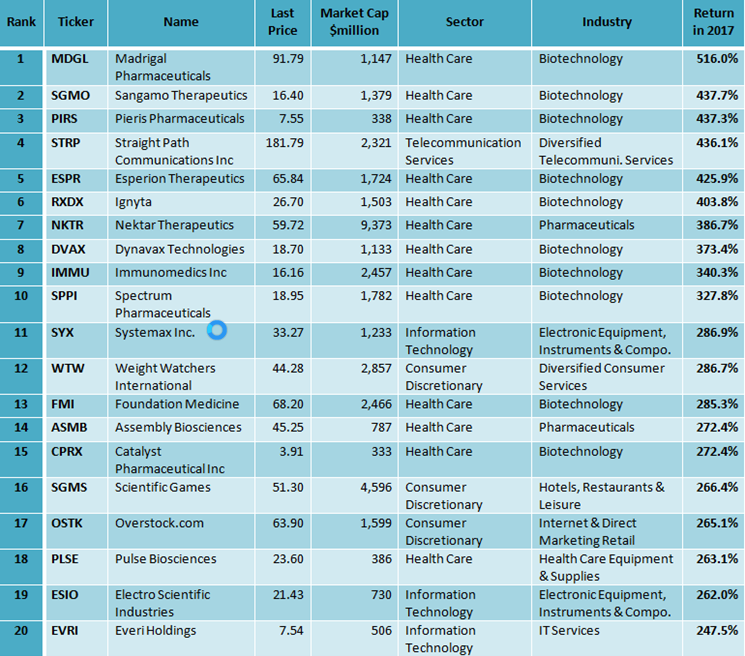

The table below presents the best 20 Russell 2000 performers in 2017, their market cap, sector and industry and the total return (price appreciation plus dividend yield) in 2017.

It can be seen from the table above that most companies 13 of 20 were from the Health Care sector, and the Information Technology and the Consumer Discretionary sectors contributed three companies each. An investor that has managed to buy one of the 20 best performing small cap stocks could be very satisfied with a return of between 247% to 516% in one year.

Worst Performers

The table below presents the worst 20 Russell 2000 performers in 2017, their market cap, sector and industry and the total return (price appreciation plus dividend yield) in 2017.

The Health Care sector contributed the most companies among the 20 Russell 2000 worst performers with six companies. The Consumer Discretionary sector and the Information Technology had five companies each among the 20 losers. Investors in one of the 20 worst performers should be quite disappointed losing between 70% to 87% when the broad small cap market has gained about 13%.

What Now?

Leave A Comment