EUR/USD

The EUR/USD pair rallied significantly during the trading session on Wednesday, slicing through the 1.20 level at one point. However, we get back quite a bit of the gains, and ended up forming a bit of a shooting star. The shooting star show signs of exhaustion, and I think that the market could go looking towards the uptrend line that I have on the chart just below. I think that could have the market looking towards the 1.1850 level. Otherwise, we could break above the top of the shooting star, signaling that we could go to the 1.21 level above, which is an area that resistive. If we can break above that level, the market should continue to go much higher. That signifies that the uptrend continues, but I think that the market probably has a lot of work between now and then to get going.

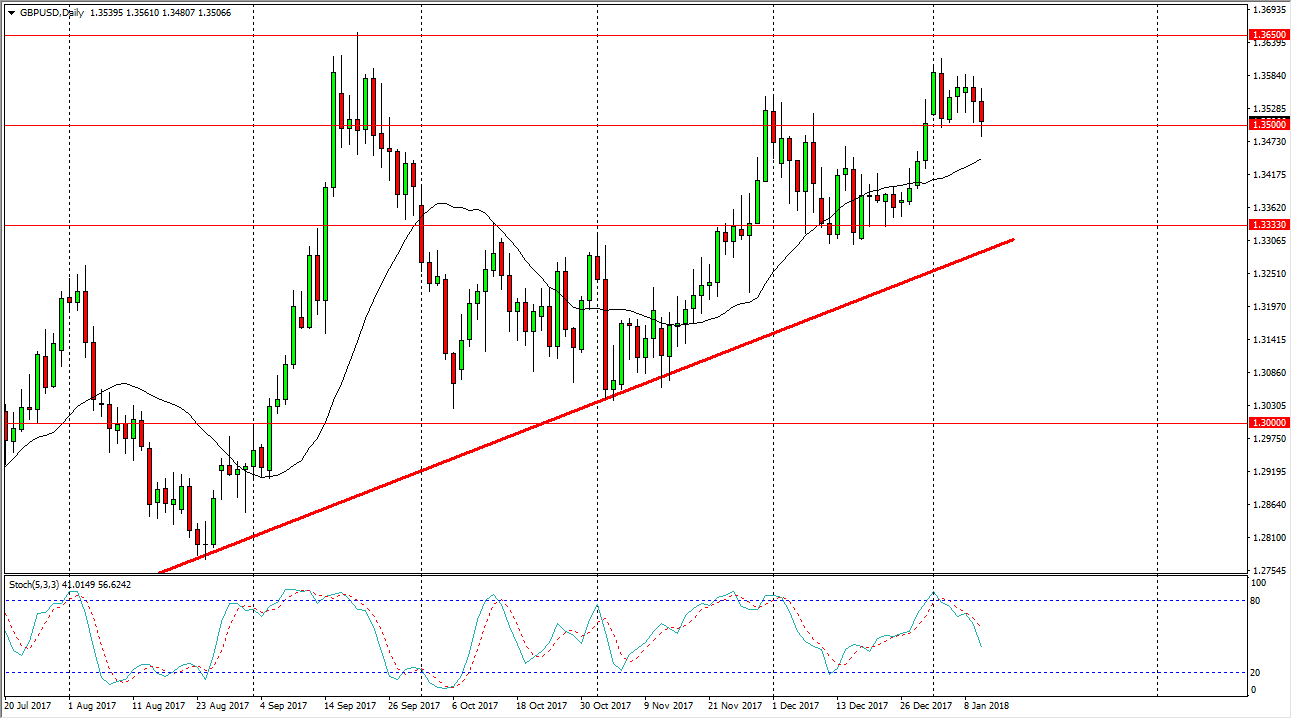

GBP/USD

The British pound went back and forth during the trading session on Wednesday, and at one point in time even broke below the 1.35 handle. However, we did see some buyers come back into the marketplace, showing signs of resiliency yet again. I think that the market probably goes to the 1.3650 level above, which is massively resistive. I think if we can break above there, the market should continue to go much higher, giving us an opportunity to be more of a “buy-and-hold” situation, and I think at that point we should continue to be ready to go much higher. I think that the uptrend line underneath, and the 1.3333 handle should offer opportunity for buyers to get involved based upon value as well. I have no interest in shorting the British pound, and I believe that it continues to be bullish overall.

Leave A Comment