Guess?, Inc. (GES – Free Report) posted fourth-quarter and fiscal 2018 results, with the top and bottom lines surpassing the Zacks Consensus Estimates, and improving year on year. Results were driven by strong revenue growth, especially in the European and Asian regions. Further, the company provided an encouraging outlook for fiscal 2019.

The strong performance, combined with sturdy plans for future growth, raised investors’ optimism on the stock, that depicted 12.2% growth during the after-hours trading session on Mar 21. Moreover, this Zacks Rank #1 (Strong Buy) stock has surged 45.6% in the past year compared with the industry’s rally of 25.8%.

Quarter in Detail

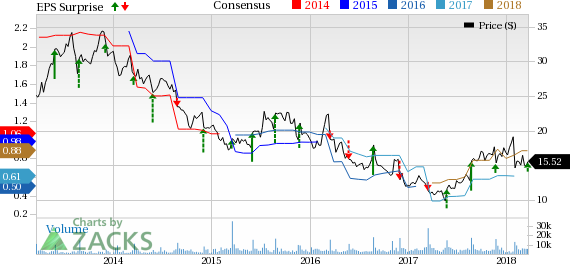

Adjusted earnings were 62 cents per share, surpassing the consensus mark of 53 cents and improving 44.2% from the year-ago quarter’s level. Notably, this marked the company’s fourth consecutive earnings beat. During the quarter, currency had a positive impact of 4 cents on earnings. Further, increase in revenues fueled the company’s overall performance.

Guess?, Inc. Price, Consensus and EPS Surprise

|

Net revenues amounted to $792.2 million, up 17.5% year over year. This marks the sixth straight quarter of revenue improvement. On a constant-currency basis, revenues grew 10.2%. The upside can be attributed to solid sales in the Europe, Asia and Americas Wholesale segments. These were partly offset by soft revenues in the Americas Retail. Notably, the top line came ahead of the Zacks Consensus Estimate of $751 million.

Gross profit improved 24% to $295.1 million on the back of higher revenues. The company’s gross margin also expanded 210 basis points (bps) to 37.2%, owing to lower markdowns and rents, and increased IMU’s. These upsides were partially offset by occupancy deleverage stemming from increased European logistics costs.

Adjusted operating profit for the quarter was $70.7 million, up 31.2% from the prior-year quarter. Operating profit during the quarter gained from improved revenues and gross profit, partially countered by increased selling, general and administrative (SG&A) expenses led by resetting of performance-based compensation. Also, adjusted operating margin rose 90 bps to 8.9% gaining from overall expense leverage, offset to a certain extent by increased performance-based compensation.

Leave A Comment