Impressive Economic Acceleration

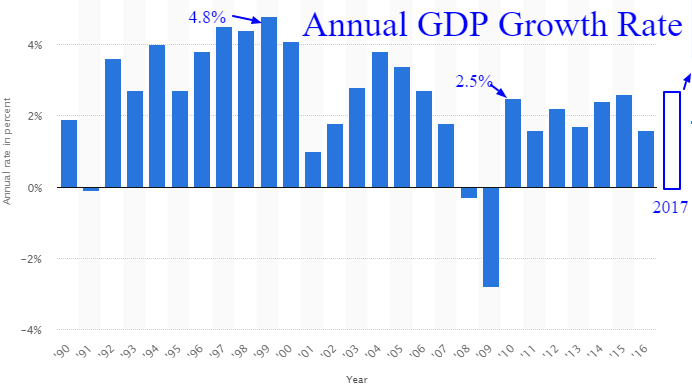

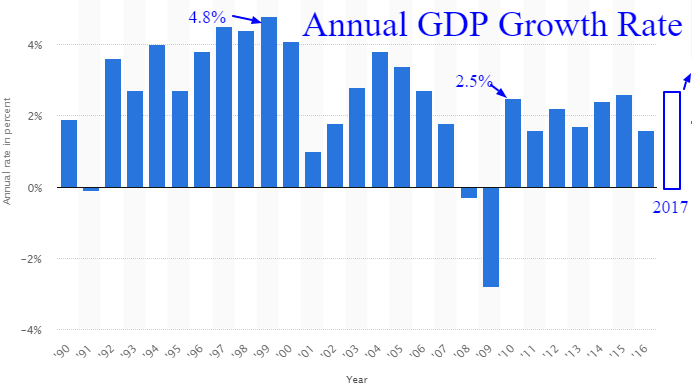

Our theme for 2018 is for an even stronger economy accompanied by slowing stock market growth as compared to 2017. Much of the slow recovery since 2009 has been on the backs of the consumer without the normal contribution of Investment Spending and Exports. The new expansion cycle we entered in 2016 appears to have sparked a return of more normal growth in the Investment and Export components of GDP. Other than temporary inventory declines due to a strong economy, we expect 2017 will hit an 11 year high GDP growth rate and 2018 will witness our first annual growth rate above 2.7% since 2005.

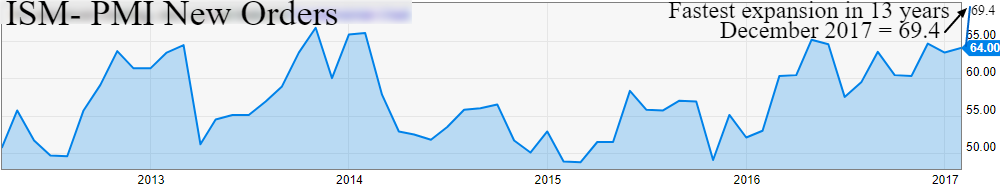

US and European manufacturing are expanding at a pace unseen for 10 to 20 years. New Orders and New Employees Needed are extremely strong. Supplier Delivery Times and Backlogs are extremely weak – which is a strong positive showing the need for future inventory build and expanded transportation activity. ISM New Order expectations are at 13 year highs while demand for adding new employees is near 10 year highs.

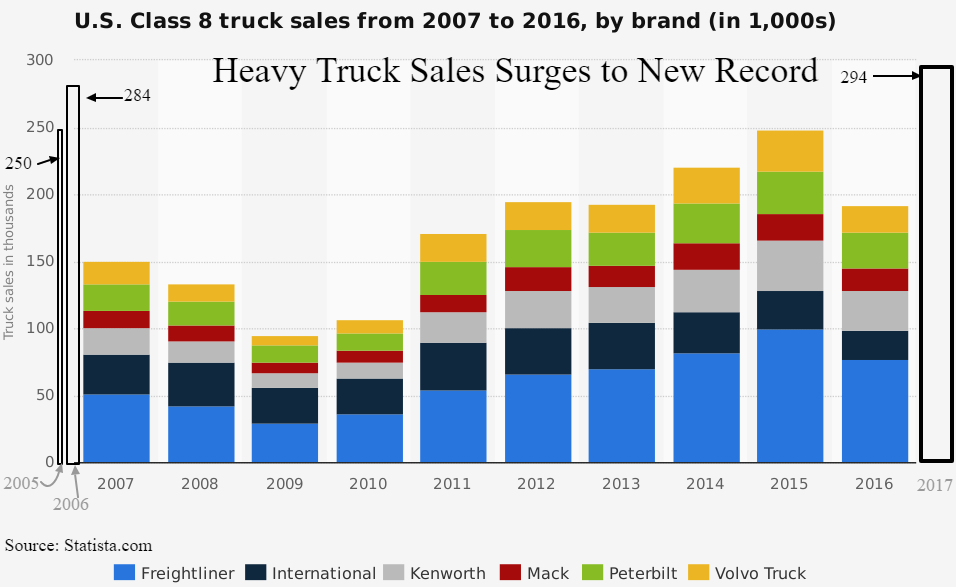

Manufacturing strength can be seen in proxies hitting new all time records such as Heavy Duty Truck Orders and Truck Tonnage. This has assisted the Transportation stock index to rocket higher to new all time records – up 14% in the past 2 months, double the gains of the SP or Dow Industrials.

The long dormant Goods Producing sector of the world as measured by Manufacturing is near the most robust expansion rate levels ever recorded in many European countries. Global manufacturing is the strongest in almost 7 years and even lowly Greece joined the party with job creation, exports and better business activity that hasn’t been seen in over “9 years”. This is not a “long in the tooth” economy. The engines on this economic train are still shaking off the rust of cold storage with plenty of pent up demand potential ahead before credit tightening can slow its progress. What’s amazing about these manufacturing surges around the globe is that they are exploding higher after years of slow but steady growth, unlike the easy comparison rubber-band rallies that occur after deep recessions.

Leave A Comment