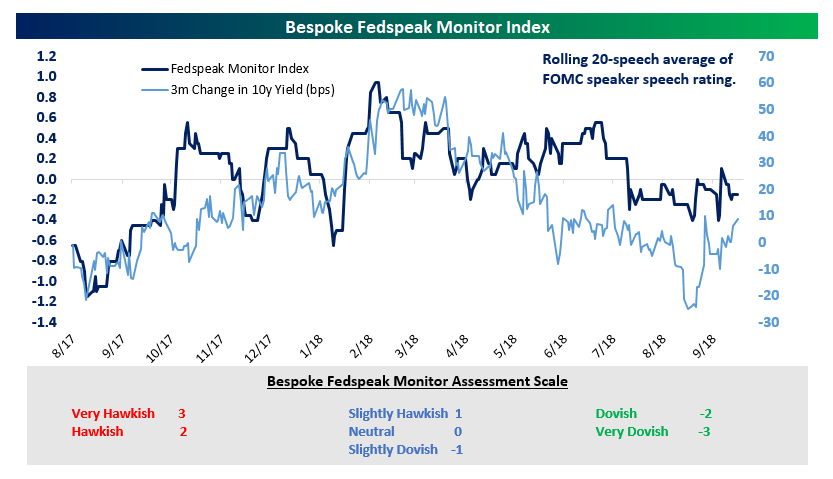

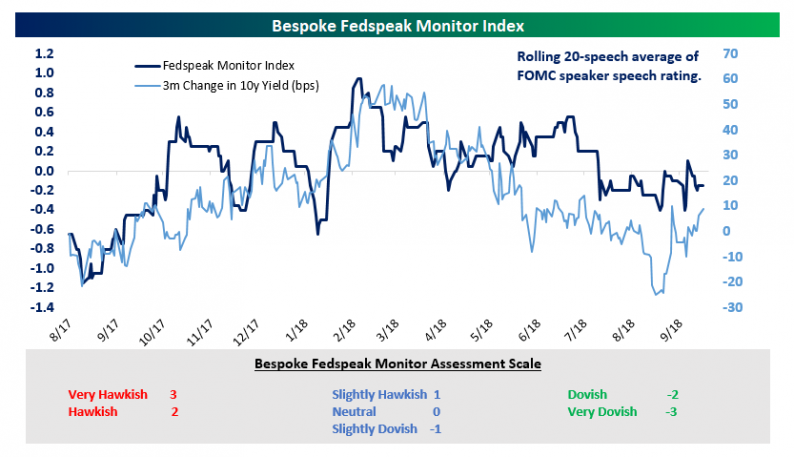

Recent speeches of FOMC members have leaned very slightly towards dovishness over the last few months, but that doesn’t mean there haven’t been active arguments between hawks and doves! For instance, Atlanta Fed President Bostic (a voter) has tilted more dovish lately, wanting only 1 more hike and no further hikes once the Fed reaches “neutral” (i.e., a rate that won’t either support or hold back economic growth). St. Louis Fed President Bullard has fretted about the yield curve and argued there’s little upside risk to inflation in recent speeches. On the other hand, Governor Brainard argued the Fed needed to think about raising rates above neutral in the longer-run last week, a relatively hawkish perspective given most speakers want to hit neutral and re-assess. Finally, ardent dove Evans of the Chicago Fed (a non-voter) had a speech last week arguing for “normalized” rates, a hawkish sign. At the end of the day, though, all of this discussion has basically been a wash with the Bespoke Fedspeak Monitor index in roughly the same very slightly dovish position over the last few months.

Leave A Comment