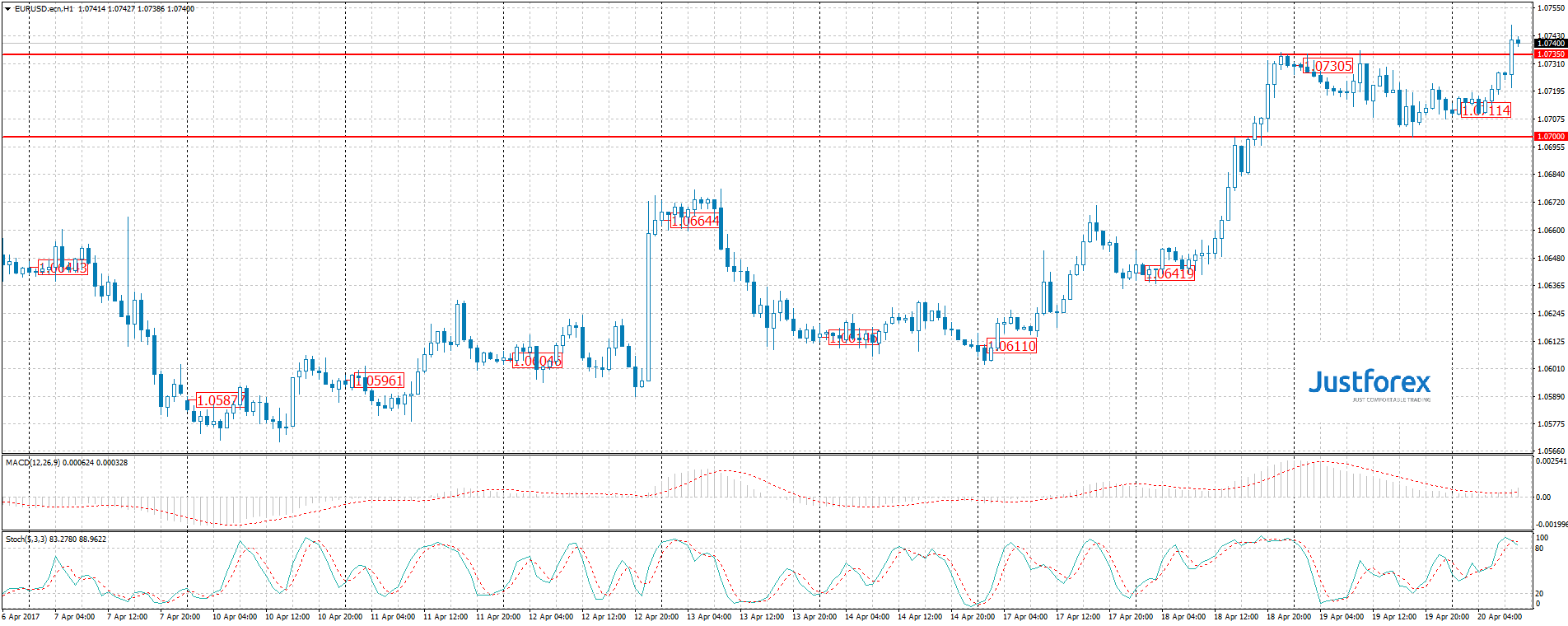

Forecast for the EUR/USD currency pair

Technical indicators of the currency pair:

Prev Opening: 1.07305

Opening: 1.07114

Chg. % of the last day: -0.21

Daily range: 1.07078 – 1.07475

52-week range: 1.0366 – 1.1616

Yesterday, the correction was observed on EUR/USD. At the same time, the price kept a round level of 1.07000, which caused a further growth of the single currency. At the moment the EUR/USD quotes have overcome local resistance 1.07350. The attention is focused on the first round of the presidential elections in France, which will be held on April 23.

The MACD histogram is in the positive area and continues to rise, indicating further growth of the EUR/USD currency pair.

Stochastic Oscillator has reached the overbought zone, the %K line crossed the %D line. There are signals at the moment.

The news background on the EU economy is calm today. It is necessary to pay attention to statistics from the USA:

– the number of initial claims for unemployment benefits (15:30 GMT+3:00);

– the indices of industrial activity and employment from the Federal Reserve Bank of Philadelphia (15:30 GMT+3:00).

Trading recommendations

Support levels: 1.07350, 1.07000

Resistance levels: 1.08000

We expect a bullish sentiment on the EUR/USD currency pair. We recommend looking for entry points to the market to long positions. The movement is tending potentially to 1.07750-1.08000.

Forecast for the GBP/USD currency pair

Technical indicators of the currency pair:

Prev Opening: 1.28394

Opening: 1.27723

Chg. % Of the last day: -0.48

Daily range: 1.27699 – 1.28371

52-week range: 1.1986 – 1.5020

Yesterday, there was a corrective movement on GBP/USD. The pound lost in price more than 60 points. Nevertheless, during the Asian trading session, the currency kept the local support level of 1.27750. At the moment, the technical pattern indicates further growth of GBP/USD.

Leave A Comment