The fund-of-funds ETF structure provides an efficient and economical approach to the implementation of many investment strategies. Although critics often complain that fund-of-funds ETFs only put fees on top of fees, the reality is often quite different, making the structure a welcome addition to the investment world.

Typically, an ETF directly owns the securities in the index it is tracking. For example, the SPDR S&P 500 ETF (SPY) owns all 500 stocks in the index. When the index adds or removes a stock, the ETF does the same thing. However, a fund-of-funds ETF owns other ETFs instead of own the underlying stocks, bonds, or other securities directly. Why do they do this? For the same reason you buy ETFs. It is much more efficient and cost-effective to buy a single S&P 500 ETF than it is to buy all 500 stocks in the S&P 500 in their proper allocations and to manage all the index changes.

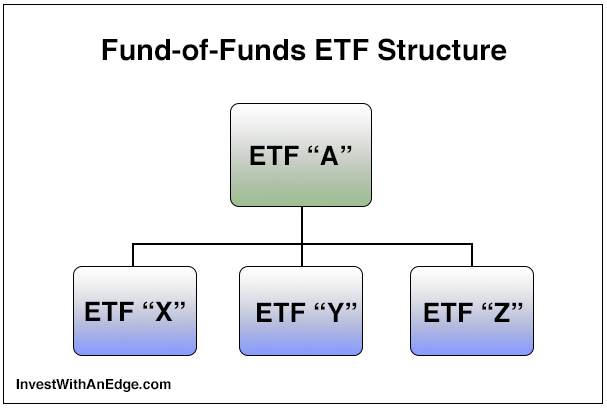

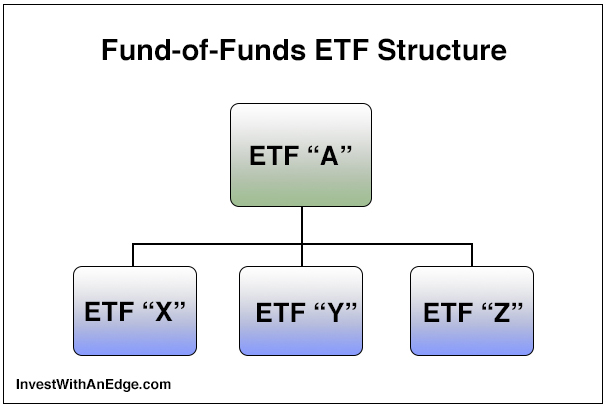

The accompanying diagram illustrates the concept. In this example, ETF “A” is a fund-of-funds ETF that has only three holdings. Each of those holdings are traditional ETFs that directly own the underlying securities. Let’s assume ETF “A” is pursuing a traditional 60/40 asset-allocation strategy of having 60% invested in stocks and 40% invested in bonds. It also makes the further allocation of having two-thirds of its stocks in U.S. companies and one-third in foreign equities.

For its 40% U.S. stock exposure, ETF “A” could buy the Vanguard Total Stock Market ETF (VTI), or it could buy the 3,578 stocks that VTI owns. For its 20% foreign equity allocation, ETF “A” could buy the Vanguard Total International Stock ETF (VXUS), or it could buy the 6,060 securities that VXUS owns. For its 40% bond allocation, ETF “A” could buy the iShares Core U.S. Aggregate Bond ETF (AGG), or it could buy the 6,086 bonds and securities that AGG holds.

Therefore, ETF “A” has the choice of buying three ETFs, or it could buy all 15,724 stocks and bonds that those three ETFs are holding. Most of you would agree that buying the three ETFS would be the most cost-effective and efficient approach, even if those ETFs came with their own expense ratio.

Leave A Comment