Intense negotiations over the weekend have resulted in some kind of draft agreement between the European Union and the UK. While the agreement is vague on various matters, actually getting to a draft agreement and a few wins there for UK PM Cameron have some influence.

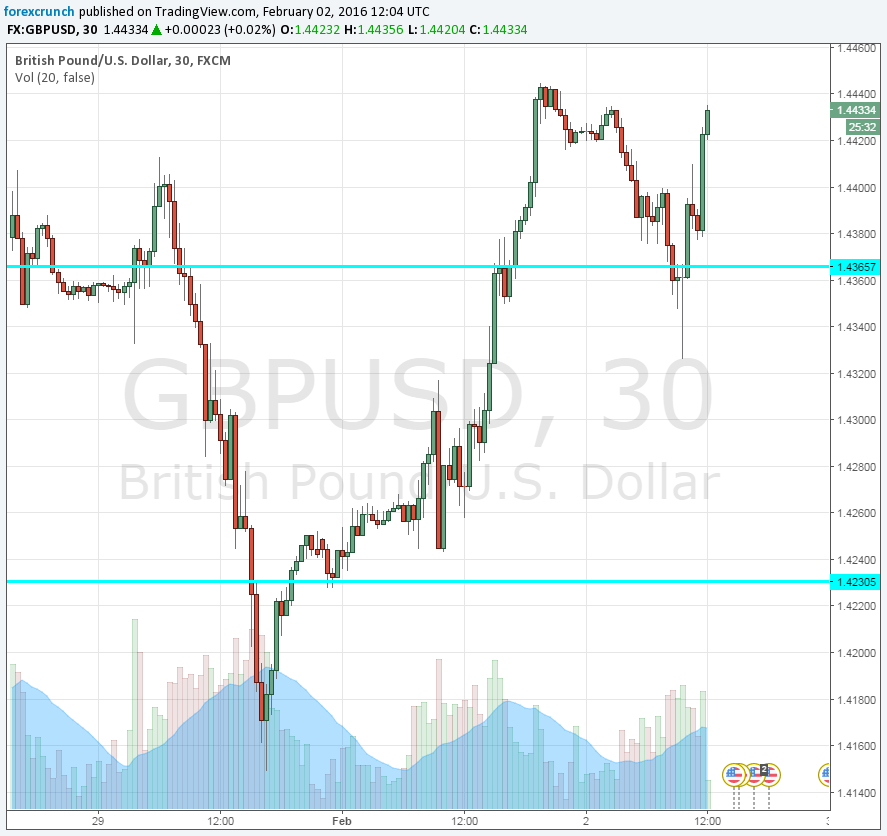

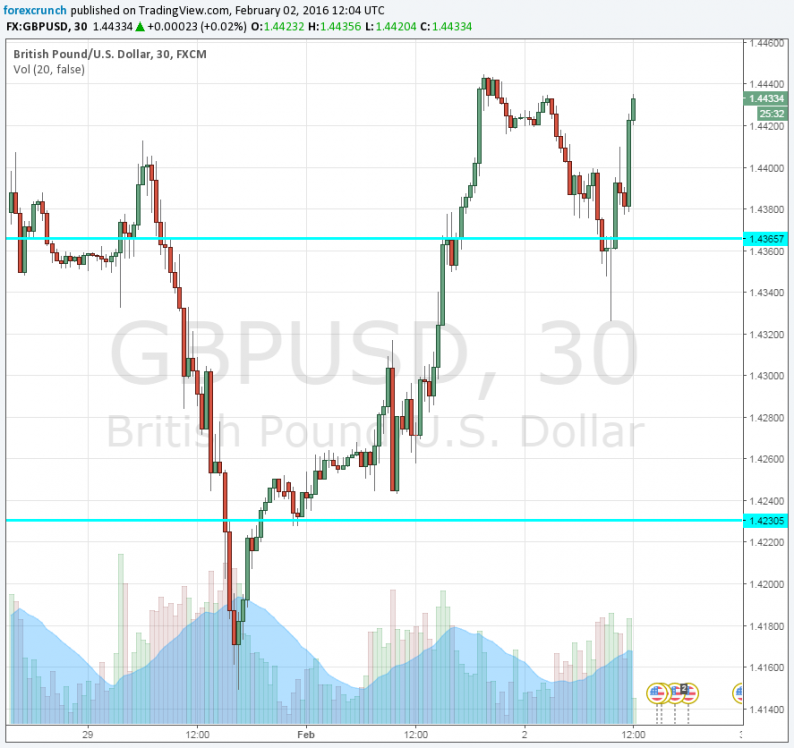

GBP/USD is rebounding from the lows seen after the poor construction PMI and is looking towards the highs.

Any kind of agreement that includes any kind of concession from the EU would be hailed by David Cameron. His big business donors would like to get a deal as soon as possible and keep Britain in the single market. The need to satisfy right-wing Tories and to prevent a rise of UKIP led to the promise of the referendum, but is certainly not a desire of the mainstream in the party.

Getting a deal and getting over the referendum is a priority for the government and also for the pound. The uncertainty about Britain’s place in the EU weighs on the pound, as did the Scottish referendum. And once it’s over, it’s a relief rally.

The details released include allowing the UK an “emergency brake” on migrant benefits. The refugee crisis is a very sensitive issue in Britain, and UKIP has often been associated with xenophobia. In addition, the substance of the deal will be integrated into EU treaties, something that makes it more powerful.

The pound enjoys a significant rally, rising from around 1.4380 to 1.4445 and approaching resistance at 1.4450. Earlier in the day, the weak data sent it all the way to 1.4325. Support awaits at 1.4365, followed by 1.4230. Resistance above 1.4450 awaits only at 1.4560.

GBP/USD chart:

Leave A Comment