You know by now that I think gold is above all a commodity, and in a bubble that was more extreme than stocks… a bubble that’s been bursting since September 2011, but…

Gold and bitcoin are two examples of bubbles bursting that are NOT following my bubble model as well as most. Both, thus far, are basing out at higher levels than I expected.

I still see gold moving substantially lower – to at least the $700 per ounce mark that it crashed into in 2008 – when the next global crash sets in. At worst it could crash towards its bubble origin in mid-2005, around $400. At that point it would be the best buy since 2000-2005, with the 30-year Commodity Cycle to follow into 2038-2040.

I’ve already warned that gold was due to fall further when it broke a key trend line back in early June… and it fell over $100 since.

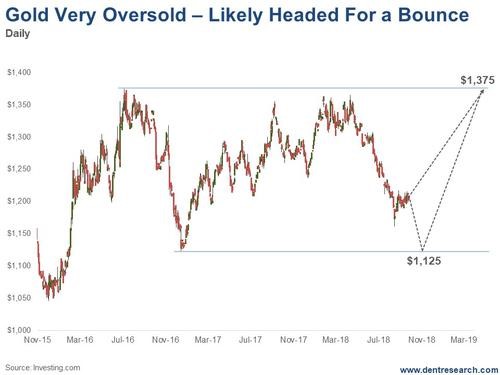

But now it’s getting extremely oversold, as Lee Lowell noted in The Rich Investor last Thursday. Gold is due for a significant bounce again, but likely after one more move down to stronger support around $1,125. That’s why Lee showed two ways to play this bounce in the next several months using options.

So, here’s the two most likely scenarios we’ll see in gold ahead…

Most likely, gold will head down one more time. That would likely be stimulated by a rise in the dollar again, which has retreated from 107 down to 103 near support while still clearly in a more bullish trend.

Gold’s strongest support would be at the December 2016 low around $1,125. At that point it would be severely oversold. Then we could see a bounce back to recent highs of $1,375, and possibly a bit higher to $1,400 or so. That would complete its bear market rally back from $1,150 in December 2015. (A while back I warned we would see this rally, despite being bearish on gold.)

This will give investors interested in gold one more chance to profit by buying near term. Or playing options, as Lee suggests.

Leave A Comment