Gold prices settled at $1156.47 per ounce, rising nearly 1.7% over the course of the week, on speculation that a U.S. rate hike may take longer than expected. The greenback came under pressure after minutes of the Federal Reserve’s latest meeting revealed that policy makers “decided that it was prudent to wait for additional information confirming that the economic outlook had not deteriorated”. The economic numbers coming out of the U.S. lately have been a bit disappointing and that dimmed already faint prospects for an interest rate hike in October.

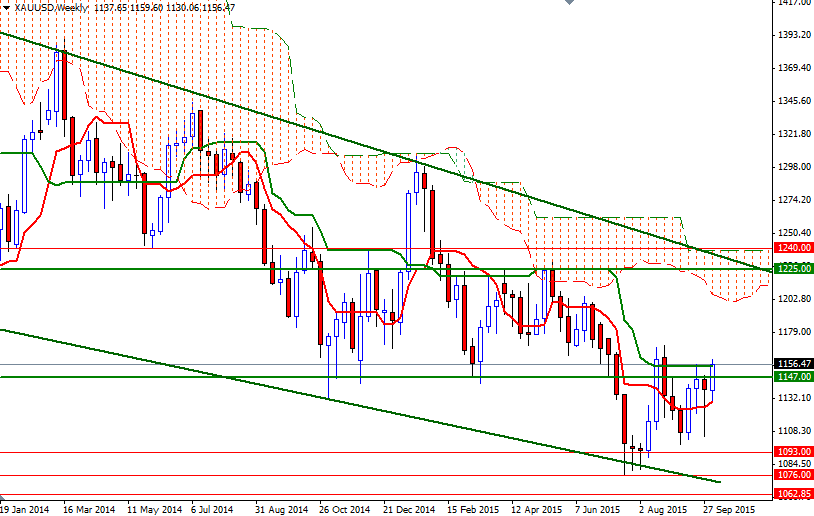

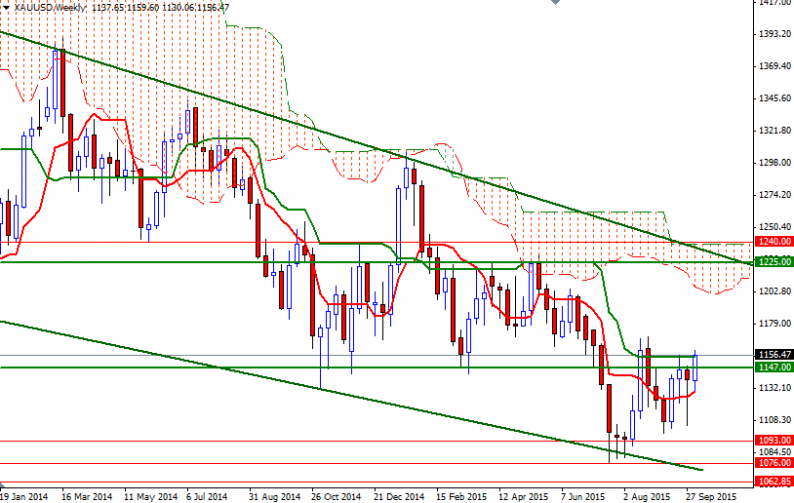

Friday’s data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 86819 contracts (the highest level in fifteen weeks), from 76645 a week earlier. Despite the negative long-term outlook, the daily and 4-hourly charts are bullish at the moment. The XAU/USD pair is trading above the Ichimoku clouds and in addition to that the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) lines are positively aligned on both time frames. Adding to the positive outlook is the daily Chikou-span (closing price plotted 26 periods behind, brown line) which advanced beyond the daily cloud.

Since last week, I have been repeating that the bulls are stronger than the bears. However, I would advise caution as the market approaches the 1170/65 region which blocked the bulls’ way last month. XAU/USD will need to break over the 1176.50 level in order for the rally to be sustained and proceed to the weekly cloud. On the other hand, if the bears manage to defend their camp in the 1165/3.50 zone and increase pressure, prices may test the supports at 1154.62 and 1148.80/7.00. Diving back below 1147 would suggest that we might head back to the 1141/38 area. Sellers have to eliminate the 1131.85/7.0 support in order to gain enough momentum to march towards the short-term ascending trend line.

Leave A Comment