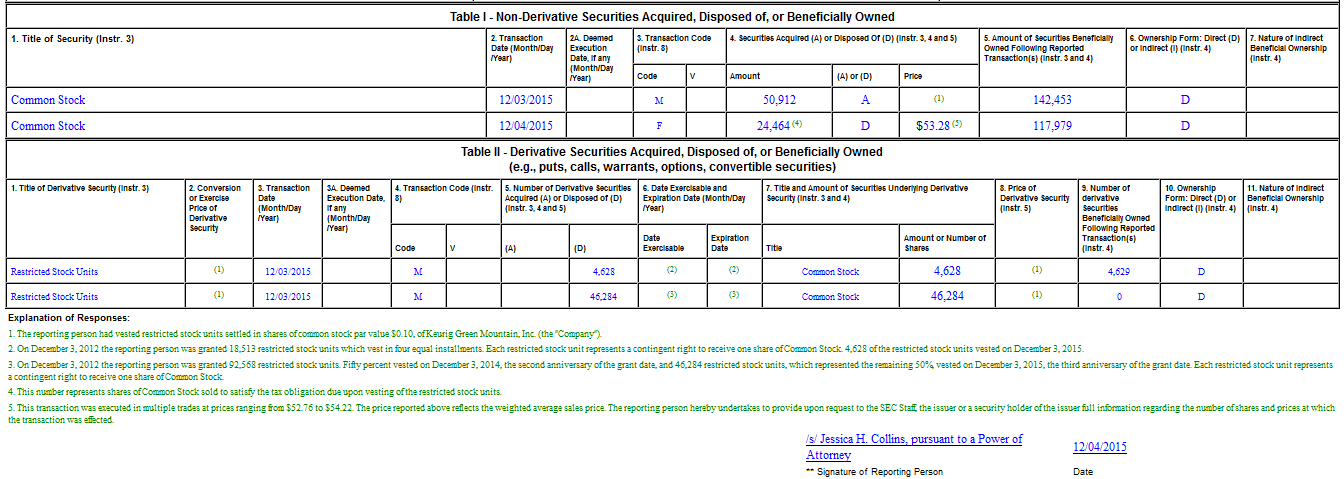

This morning, Green Mountain Coffee (GMCR) announced that they’re being acquired for $92/share in cash. Amazingly, their CEO, Brian Kelley, filed a form 4 on Friday evening referencing some trades from Thursday Dec 3rd. Ignore the cutesy “33 Coffee Ln” address…What we want to focus on is the details (click to enlarge, or click the link):

Kelley, like most executives, receives Restricted Stock Units as part of his compensation. When these units vest, he owes taxes on the them. What happens quite frequently, including in this situation, is that the company withholds a quantity of shares equal to the tax liability and sells them.

What’s fascinating here is that Kelley had to know that his company was in advanced talks to be sold. Another option for holders of vesting RSUs is to send in a check for the tax liability of the shares. Usually, since the recipient of RSUs has a significant portion of his wealth already tied to the company’s stock, it’s common to just sell a portion of the shares to pay the tax liability. Kelley presumably could have paid his $1.3 MM tax liability without selling these shares, and he would have realized an additional $900,000 in gains this morning on his position!

Continue reading at Kid Dynamite’s World.

Leave A Comment