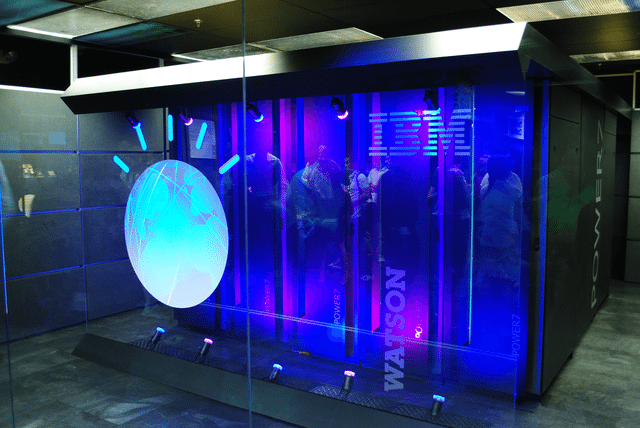

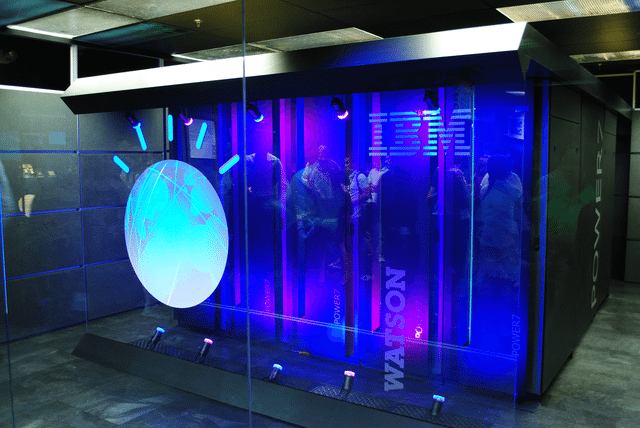

A very cool tool which mastered jeopardy and more but is IBM’s Watson hurting returns?

IBM’s second quarter results, published earlier this week, make for dismal reading. Big Blue unveiled its 21st straight quarter of revenue contraction, and even though the company topped analysts’ expectations for profit, once again the bottom line was boosted by some one-off figures, something the company has become increasingly dependent on to meet targets in recent years. Pro forma earnings per share of $2.97 beat expectations of $2.75 but a one-off tax benefit in the quarter added $0.18 to earnings per share.

The results also showed that growth at IBM’s so-called “strategic imperatives” divisions slowed significantly, from 13% in the first quarter to just 7% after adjusting for currency swings. The “strategic imperatives” are the cloud, analytics, mobile, social and security businesses on which Big Blue has pinned its hopes for future growth, and without growth here, prospects for the technology giant look dim.

By Clockready (Own work) [CC BY-SA 3.0 or GFDL], via Wikimedia Commons

IBM has pinned its hopes for growth on the success of its strategic imperatives and Watson supercomputer, which it hopes will become the go to provider for businesses looking to expand their AI and deep learning capabilities. However, analysts at investment bank Jefferies aren’t so sure that this will be the answer to all of IBM’s problems.

IBM’s Watson Worth Less Than The Cost?

According to a new research report on IBM from Jefferies, Watson has dominated the company’s investor communications over the past few years clocking up a staggering 200 mentions in prepared remarks and earnings calls since the first quarter of 2013. What’s more, the company has spent an estimated $15 billion developing the initiative, excluding $5 billion spent on data acquisitions since 2015. This spending, as well as the academic input from IBM employees, has created, in the words of Jefferies, “one of the most complete cognitive platforms available in the marketplace today.” However, while the platform is enormously powerful Jefferies’ analysts write that “many new engagements require significant consulting work to gather and curate data, making some organizations bulk at engaging with IBM.”

Leave A Comment