Embrace uncertainty – Anyone who doesn’t follow this momentous maxim in coming years is likely to get one unpleasant shock after the next. Because the stable progression of the world economy since WWII is now coming to an end. What should have been a normal cyclical high in the next year or two, is now going to be the most massive implosion of a bubble full of debts and inflated assets. The system has been “successfully” manipulated for decades by central banks, certain commercial banks, the BIS in Basel and the IMF for the benefit of a small elite.

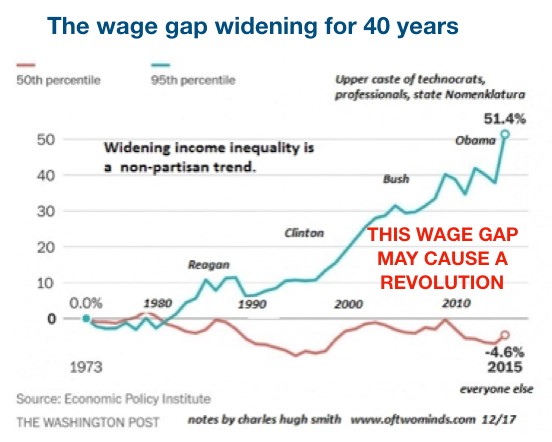

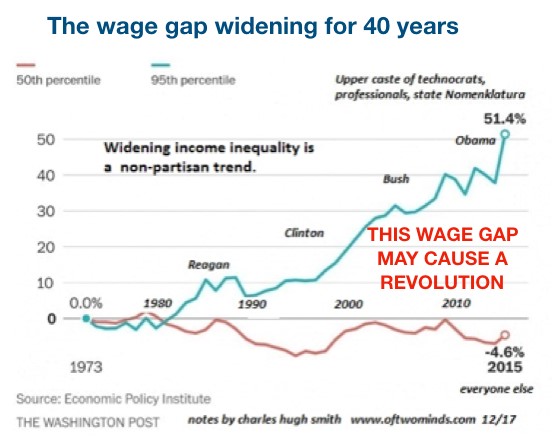

INCOME GAP – FUEL FOR SOCIAL UNREST

Just look at the chart of the growing wage gap in the US between the top 5% and the middle 50% since 1973. The top group has had a 51% increase whilst the middle one has had a 4% decrease in wages. This is the stuff revolutions are made of and social unrest is clearly one of the uncertainties we must be prepared for.

MOST FORECASTS WILL BE WRONG

I learned early in life to embrace uncertainty because from this moment on in anybody’s life all is uncertain. Individual lives can change very quickly and and so can the world economy and the political situation. There are times when projections and probabilities work fairly well, but the next few years will be very different.

Most investors believe that the historically predictable trajectory of stock markets will continue. And based on history why wouldn’t it, since the trend has been up for as long as anyone can remember. The corrections of 1973, 1987, 2000, 2007 are quickly forgotten as the market reaches new highs.

The average investor always feels very confident at the top of the market. He doesn’t worry about risk and even if valuations are stretched, “the stock market always goes up”.

Markets can easily become more overextended than anyone can imagine. And “it is always different today”. Investing is about risk and economic risk is today greater than anytime in history whether we look at stocks, bonds or property.

Leave A Comment