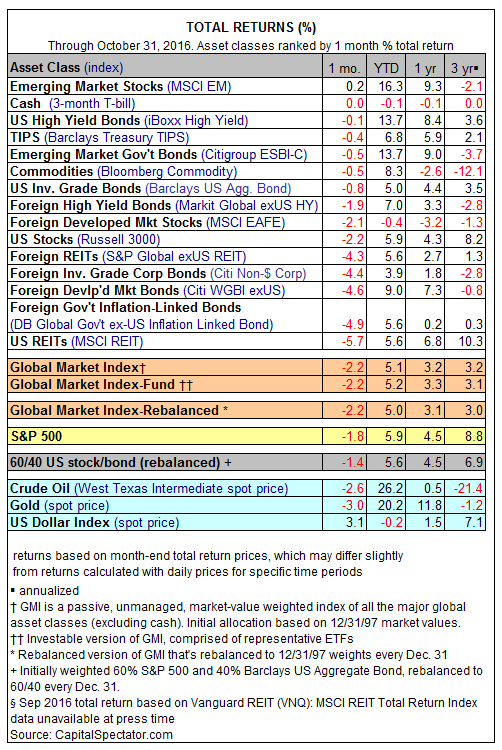

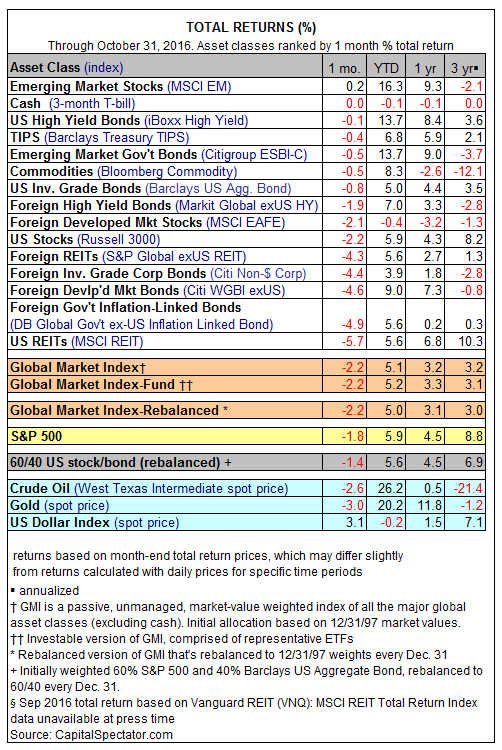

Global markets spilled a lot of red ink in October across the major asset classes. Last month’s only gainer: emerging market stocks, which edged up 0.2%, based on the MSCI EM Index. Otherwise, losses dominated the kickoff month for the fourth quarter.

The biggest decline in October: US real estate investment trusts. The MSCI REIT Index (RMZ) tumbled 5.7% — the third straight monthly decline for the asset class and its biggest setback in more than a year. US REITs are still in the black for the year-to-date change, but the formerly strong performance has been reduced to a relatively modest 5.6% total return for 2016 through Oct. 31.

Emerging-market equities continue to hold the top spot for year-to-date performance among the major asset classes. The MSCI EM Index is ahead by an impressive 16.3%, based on the net total return through the end of last month. In fact, nearly everything is sitting on gains for the year so far. The only exceptions: cash (3-month T-bills) and foreign stocks in developed markets (MSCI EAFE) via slight losses so far in 2016.

October’s downside bias took a toll on the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights. GMI shed 2.2% last month—the benchmark’s first monthly loss since January. For the year so far, however, GMI’s total return is a respectable if unspectacular 5.1% through October.

Leave A Comment