Undoubtedly, the most amusing this about the prospect of more easing from the ECB (as telegraphed by Mario Draghi last week) and the BoJ (where Haruhiko Kuroda just jeopardized his status as monetary madman par excellence by failing to expand stimulus) is that both Europe and Japan both recently slid back into deflation despite trillions in central bank asset purchases.

In other words, the market expects both Draghi and Kuroda to double- and triple- down on policies that clearly aren’t working when it comes to altering inflation expectations and/or boosting aggregate demand. Indeed, both Goldman and BofAML said as much last week. For those who missed it, here’s Goldman’s take

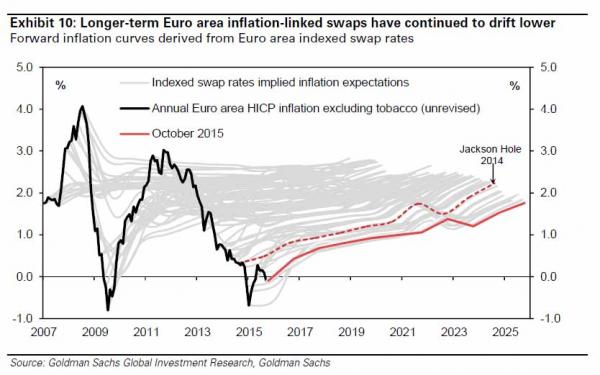

The subdued and increasingly persistent inflation dynamics that have prevailed in recent years may have eroded central banks’ best line of defence in the face of adverse disinflationary shocks. The energy-price-driven decline in Euro area inflation from 2012 to 2015 has thrown this possibility into even sharper relief.

By embarking on unprecedented balance sheet operations and forward guidance, central banks in Europe have sought to ring-fence domestic inflation expectations and signal their intention to maintain monetary conditions easy for a protracted period of time. Mario Draghi himself described the ECB’s asset purchase programme as a way of ensuring that very low (and, at times, negative) inflation does not lead wage- and price-setters to adjust their behaviour to a perceived lower steady-state rate of inflation. However, judging from market-based implied measures of longer-term inflation expectations, the effectiveness of the ECB’s announcements has proved limited so far.

Or, visually:

Meanwhile, many critics have accused the ECB of adopting policies that work at cross purposes with Berlin’s insistence on fiscal rectitude. That is, the more Draghi’s PSPP drives down borrowing costs, the less effective the “market” is at pricing risk which in turn means investors aren’t able to punish governments for budgetary blunders. In other words, Spain, Portugal, and Italy shouldn’t be able to borrow for nothing based on the fundamentals, but thanks to the ECB they can – so why implement reforms?

Leave A Comment